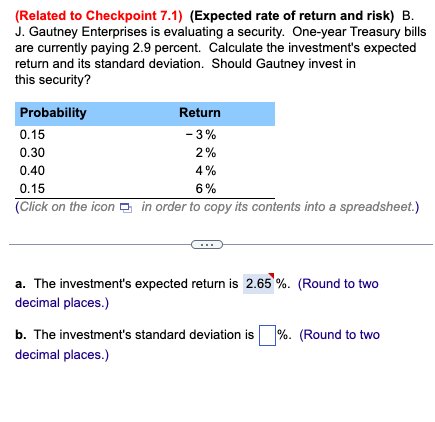

Question: (Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 2.9

(Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 2.9 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security? (Cilick on the Icon in order to copy its contents into a spreadsheet.) a. The investment's expected return is decimal places.) b. The investment's standard deviation is decimal places.) (Round to two \%. (Round to two \%. (Round to two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts