Question: (Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five

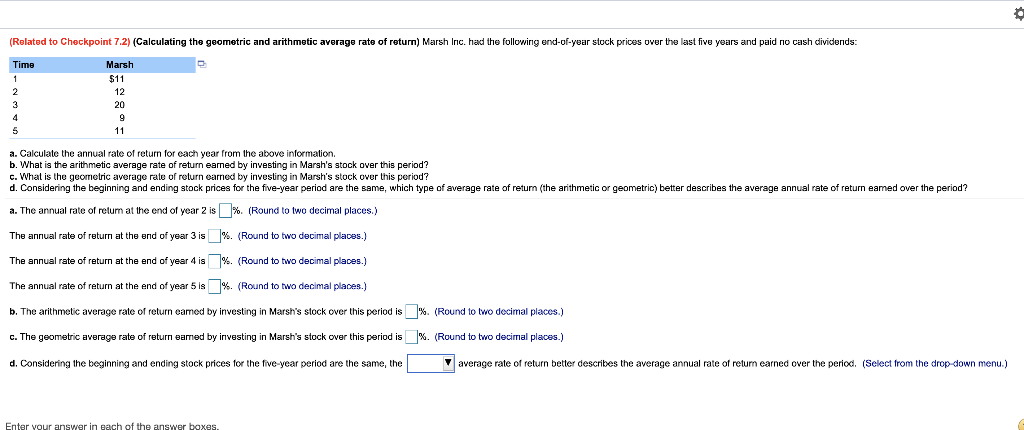

(Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends: Time Marsh $11 a. Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of return earned by investing in Marsh's stock over this period? c. What is the geometric average rate of rolurn earned by investing in Marsh's stock over this period? d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate of return the arithmetic or geometric) better describes the average annual rate of return eamed over the period? a. The annual rate of return at the end of year 2 is %. (Round to two decimal places.) The annual rate of return at the end of year 3 is %. (Round to two decimal places.) The annual rate of return at the end of year 4 is %. (Round to two decimal places.) The annual rate of return at the end of year 5 is %. (Round to two decimal places.) b. The arithmetic average rate of return eamed by investing in Marsh's stock over this period is %. (Round to two decimal places.) c. The geometric average rate of return eamed by investing in Marsh's stock over this period is %. (Round to two decimal places.) d. Considering the beginning and ending stock prices for the five-year period are the same, the average rate of return better describes the average annual rate of return earned over the period. (Select from the drop-down menu.) Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts