Question: ( Related to Checkpoint 8 . 3 ) ( Systematic risk and expected rates of return ) The following table, , contains beta coefficient estimates

Related to Checkpoint Systematic risk and expected rates of return The following table, contains beta coefficient estimates for six firms. Calculate the expected increase in the value of each firm's shares if the market portfolio were to increase by percent. Perform the same calculation where the market drops by percent. Which set of firms has the most variable or volatile stock returns?

Input the expected increase in the value of each firm's shares if the market portfolio were to increase by Round each answer to two decimal places.

tableCompanytableMicrosoft MoneyCentral MSNcomBeta EstimateExpected IncreaseComputers and Software,Apple Inc. AAPL

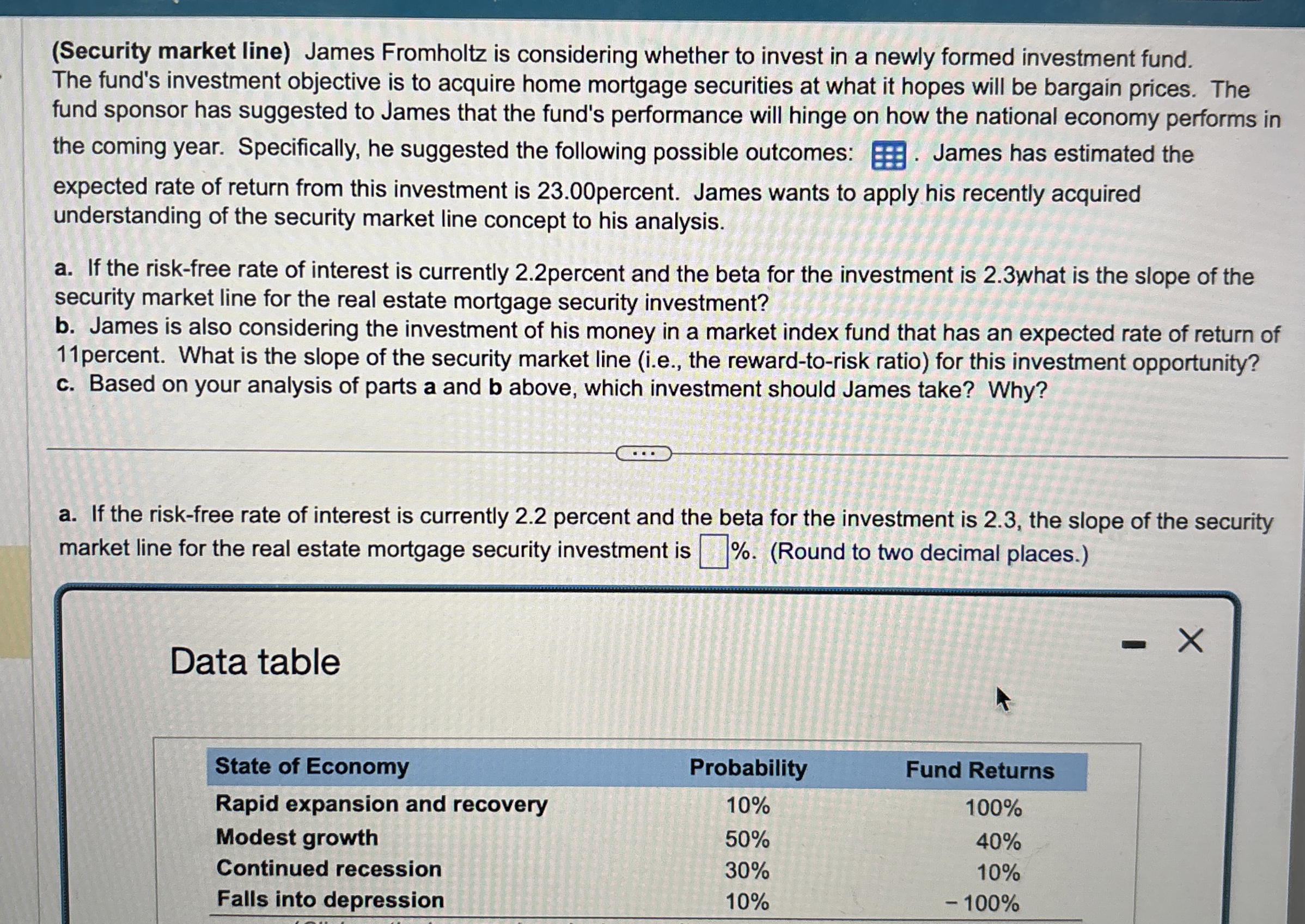

Security market line James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: James has estimated the expected rate of return from this investment is percent. James wants to apply his recently acquired understanding of the security market line concept to his analysis.

a If the riskfree rate of interest is currently percent and the beta for the investment is what is the slope of the security market line for the real estate mortgage security investment?

b James is also considering the investment of his money in a market index fund that has an expected rate of return of percent. What is the slope of the security market line ie the rewardtorisk ratio for this investment opportunity?

c Based on your analysis of parts a and above, which investment should James take? Why?

Data table

tableState of Economy,Probability,Fund ReturnsRapid expansion and recovery,

Security market line James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: James has estimated the expected rate of return from this investment is percent. James wants to apply his recently acquired understanding of the security market line concept to his analysis.

a If the riskfree rate of interest is currently percent and the beta for the investment is what is the slope of the security market line for the real estate mortgage security investment?

b James is also considering the investment of his money in a market index fund that has an expected rate of return of percent. What is the slope of the security market line ie the rewardtorisk ratio for this investment opportunity?

c Based on your analysis of parts a and above, which investment should James take? Why?

a If the riskfree rate of interest is currently percent and the beta for the investment is the slope of the security market line for the real estate mortgage security investment is

Round to two decimal places.

Data table

tableState of Economy,Probability,Fund ReturnsRapid expansion and recovery,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock