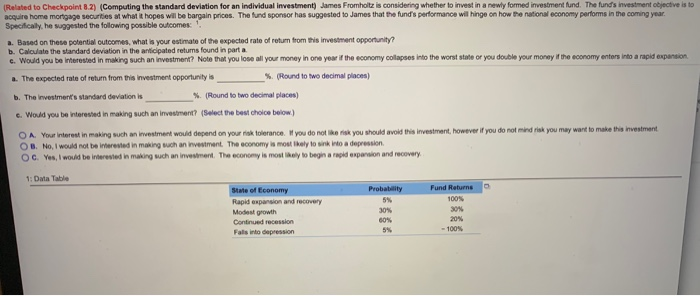

Question: Related to Checkpoint 8.2) (Computing the standard deviation for an individual investment) James Fromhoitz is considering whether to invest in a newly formed investment fund.

Related to Checkpoint 8.2) (Computing the standard deviation for an individual investment) James Fromhoitz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acoro home mor age seortes at what thopes wil be bar ainproes. The und sponsor has suggested to James t atte unds pe fo mance wil hinge on howPanato Neone Specificaly, he suggested the following possible outcomes: ypeb siine or gyer a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation in the anticipated returns found in part a c. Would you be Interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion %(Rord to two decimal laces) a. The expected rate of return from this investment opportunity is %. (Round to two decimal places) b. The investment's standard deviation is e. Would you be interested in making such an Investment? (Select the best choice below) O A. Your interest in making such an investment would depend on your risk tolerance. I you do not lke risk you should avoid this investment, however if you do not mind risk you may want to make OB. No, would not be merested in makrg an nvestment The ecromy is most Ikely to sn' no a depression. O C. Yes, I would be interested in making such an investment The economy is most ely to begin a rapid expansion and recovery 1: Data Table State of Economy 5% 30% 60% Rapid expansion and recovery Modest growh Continued recession Fals into depression 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts