Question: Remaining Time: 1 hour, 15 minutes, 14 seconds. Question Completion Status: 11.31% 11.88% QUESTION 11 Milton Industries wants to purchase new equipment that has a

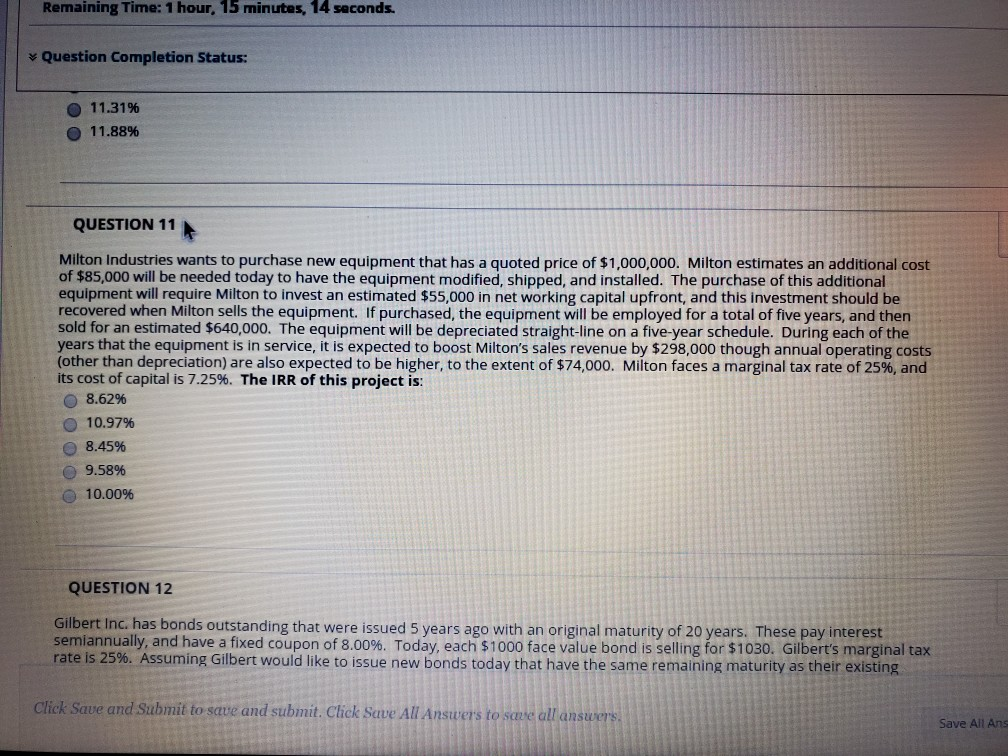

Remaining Time: 1 hour, 15 minutes, 14 seconds. Question Completion Status: 11.31% 11.88% QUESTION 11 Milton Industries wants to purchase new equipment that has a quoted price of $1,000,000. Milton estimates an additional cost of $85,000 will be needed today to have the equipment modified, shipped, and installed. The purchase of this additional equipment will require Milton to invest an estimated $55,000 in net working capital upfront, and this investment should be recovered when Milton sells the equipment. If purchased, the equipment will be employed for a total of five years, and then sold for an estimated $640,000. The equipment will be depreciated straight-line on a five-year schedule. During each of the years that the equipment is in service, it is expected to boost Milton's sales revenue by $298,000 though annual operating costs (other than depreciation) are also expected to be higher, to the extent of $74,000. Milton faces a marginal tax rate of 25%, and its cost of capital is 7.25%. The IRR of this project is: 8.62% 10.97% 8.45% 9.58% 10.00% QUESTION 12 Gilbert Inc. has bonds outstanding that were issued 5 years ago with an original maturity of 20 years. These pay interest semiannually, and have a fixed coupon of 8.00%. Today, each $1000 face value bond is selling for $1030. Gilbert's marginal tax rate is 25%. Assuming Gilbert would like to issue new bonds today that have the same remaining maturity as their existing Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Ang

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts