Question: Remaining Time: 1 hour, 34 minutes, 48 seconds. Question Completion Status: 8.90% QUESTION 6 Milton Industries wants to purchase new equipment that has a quoted

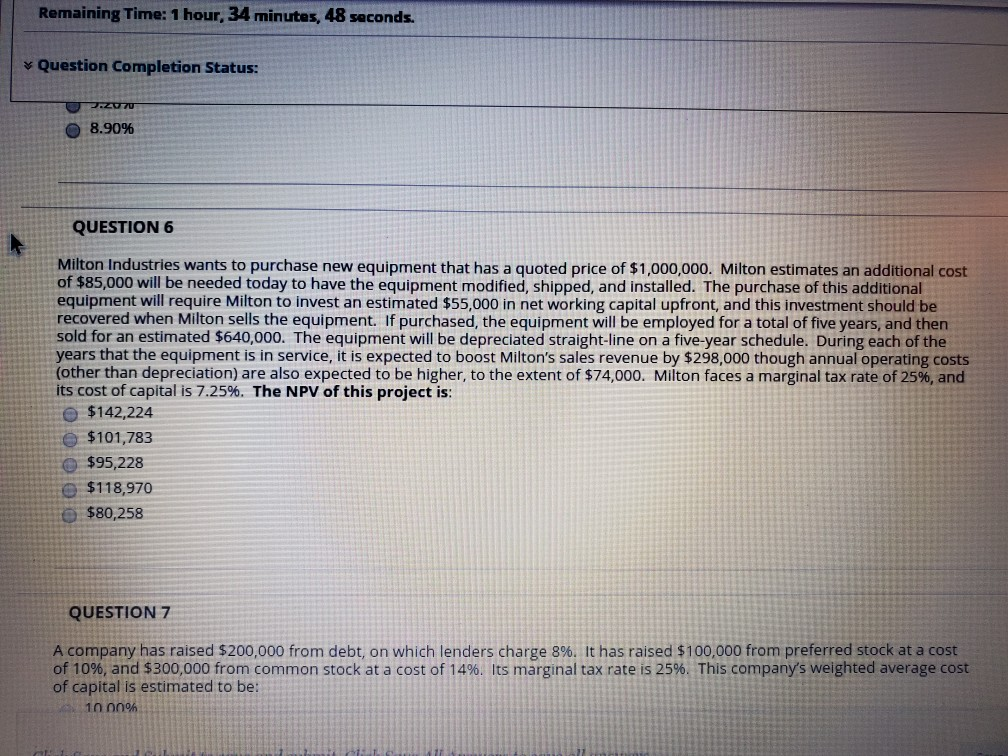

Remaining Time: 1 hour, 34 minutes, 48 seconds. Question Completion Status: 8.90% QUESTION 6 Milton Industries wants to purchase new equipment that has a quoted price of $1,000,000. Milton estimates an additional cost of $85,000 will be needed today to have the equipment modified, shipped, and installed. The purchase of this additional equipment will require Milton to invest an estimated $55,000 in net working capital upfront, and this investment should be recovered when Milton sells the equipment. If purchased, the equipment will be employed for a total of five years, and then sold for an estimated $640,000. The equipment will be depreciated straight-line on a five-year schedule. During each of the years that the equipment is in service, it is expected to boost Milton's sales revenue by $298,000 though annual operating costs (other than depreciation) are also expected to be higher, to the extent of $74,000. Milton faces a marginal tax rate of 25%, and its cost of capital is 7.25%. The NPV of this project is: $142,224 $101,783 $95,228 $118,970 $80,258 QUESTION 7 A company has raised $200,000 from debt, on which lenders charge 8%. It has raised $100,000 from preferred stock at a cost of 10%, and $300,000 from common stock at a cost of 14%. Its marginal tax rate is 25%. This company's weighted average cost of capital is estimated to be: 10 00h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts