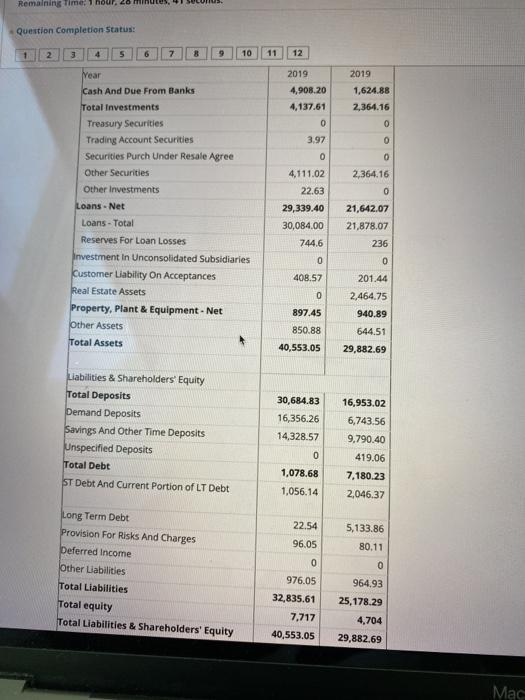

Question: Remaining Time: 1 hour. 20 Question Completion Status: 1 2. 4 5 6 7 8 9 10 11 12 2019 4,908.20 4,137.61 2019 1,624.88 2,364.16

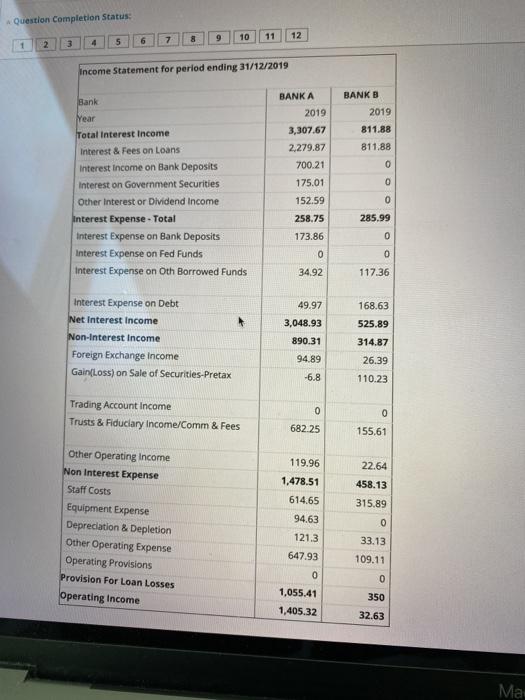

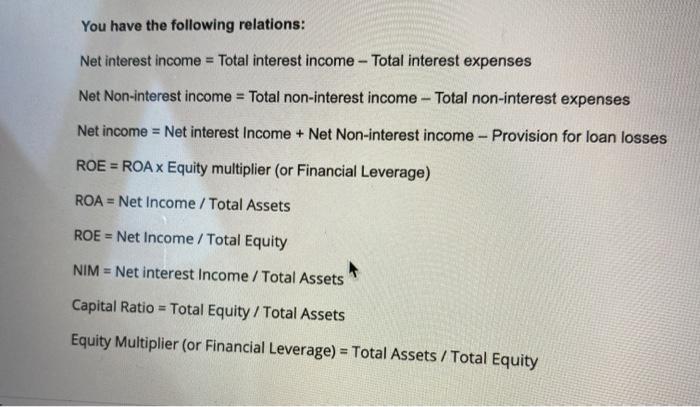

Remaining Time: 1 hour. 20 Question Completion Status: 1 2. 4 5 6 7 8 9 10 11 12 2019 4,908.20 4,137.61 2019 1,624.88 2,364.16 0 0 0 0 3.97 0 2,364.16 0 Year Cash And Due From Banks Total Investments Treasury Securities Trading Account Securities Securities Purch Under Resale Agree Other Securities Other Investments Loans - Net Loans - Total Reserves For Loan Losses Investment in Unconsolidated Subsidiaries Customer Liability On Acceptances Real Estate Assets Property, Plant & Equipment - Net Other Assets Total Assets 4.111.02 22.63 29,339.40 30,084.00 744.6 0 21,642.07 21,878.07 236 0 408.57 0 201.44 2,464.75 940.89 644.51 897.45 850.88 40,553.05 29,882.69 Liabilities & Shareholders' Equity Total Deposits Demand Deposits Savings And Other Time Deposits Unspecified Deposits Total Debt ST Debt And Current Portion of LT Debt 30,684.83 16,356.26 14,328.57 16,953.02 6,743.56 9,790.40 0 1,078.68 1.056.14 419.06 7,180.23 2,046.37 22.54 96.05 5,133.86 80.11 0 Long Term Debt Provision For Risks And Charges Deferred Income Other Liabilities Total Liabilities Total equity Total Liabilities & Shareholders' Equity 0 964,93 25,178.29 976.05 32,835.61 7,717 40,553.05 4,704 29,882.69 Mac Question Completion Status: 7 9 12 1 10 4 2 5 3 Income Statement for period ending 31/12/2019 BANKB Bank 2019 BANKA 2019 3,307.67 2,279.87 700.21 175.01 152.59 Year Total Interest Income Interest & Fees on Loans Interest Income on Bank Deposits Interest on Government Securities Other interest or Dividend Income Interest Expense - Total Interest Expense on Bank Deposits Interest Expense on Fed Funds Interest Expense on oth Borrowed Funds 811.88 811.88 OOO 285.99 258.75 173.86 0 0 0 117.36 34.92 168.63 525.89 Interest Expense on Debt Net Interest Income Non-Interest Income Foreign Exchange income Gain(Loss) on Sale of Securities-Pretax 49.97 3,048.93 890.31 94.89 -6.8 314.87 26.39 110.23 Trading Account Income Trusts & Fiduciary Income/Comm & Fees 0 0 68225 155.61 Other Operating Income Non Interest Expense Staff Costs Equipment Expense Depreciation & Depletion Other Operating Expense Operating Provisions Provision For Loan Losses Operating Income 22.64 458.13 315.89 119.96 1,478.51 614.65 94.63 121.3 0 33.13 109.11 647.93 0 1,055.41 1,405.32 0 350 32.63 Mai You have the following relations: Net interest income = Total interest income - Total interest expenses Net Non-interest income = Total non-interest income - Total non-interest expenses Net income = Net interest Income + Net Non-interest income - Provision for loan losses ROE = ROAX Equity multiplier (or Financial Leverage) ROA = Net Income / Total Assets ROE = Net Income / Total Equity NIM = Net interest Income / Total Assets Capital Ratio = Total Equity / Total Assets Equity Multiplier (or Financial Leverage) - Total Assets/Total Equity Question 1 Compare the sources of funds (funding structure) of the two banks. (5 marks) TT TT Paragraph 4 Arial % DO QUE 3 (12pt) * 5. ET =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts