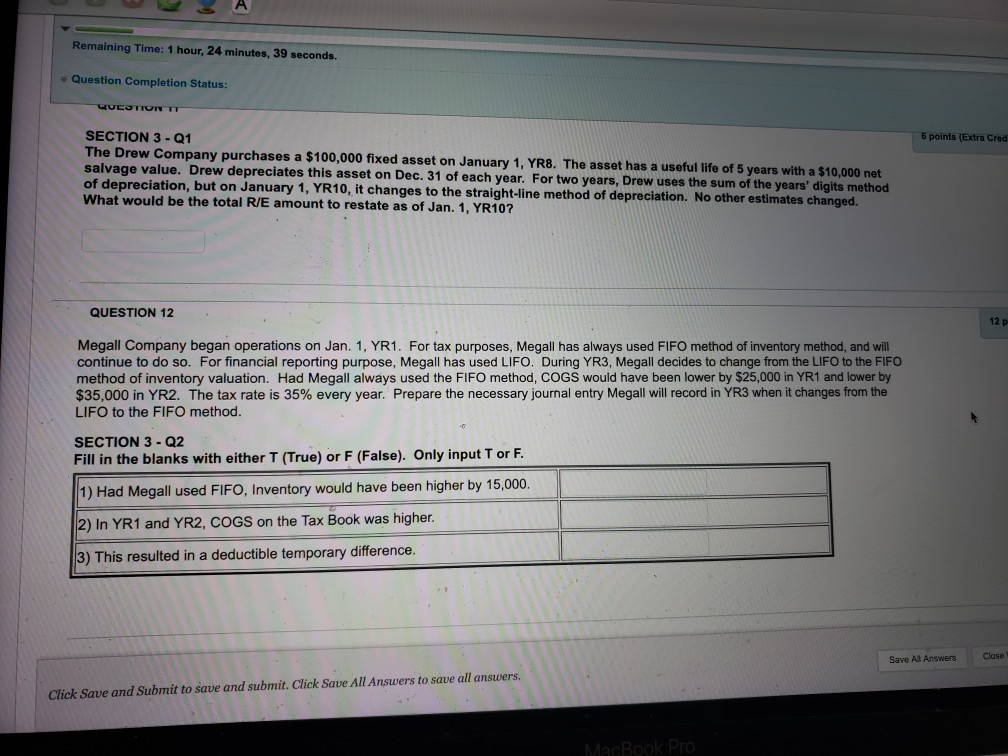

Question: Remaining Time: 1 hour, 24 minutes, 39 seconds. Question Completion Status: VULO TUNT 6 points (Extra Cred SECTION 3 - Q1 The Drew Company purchases

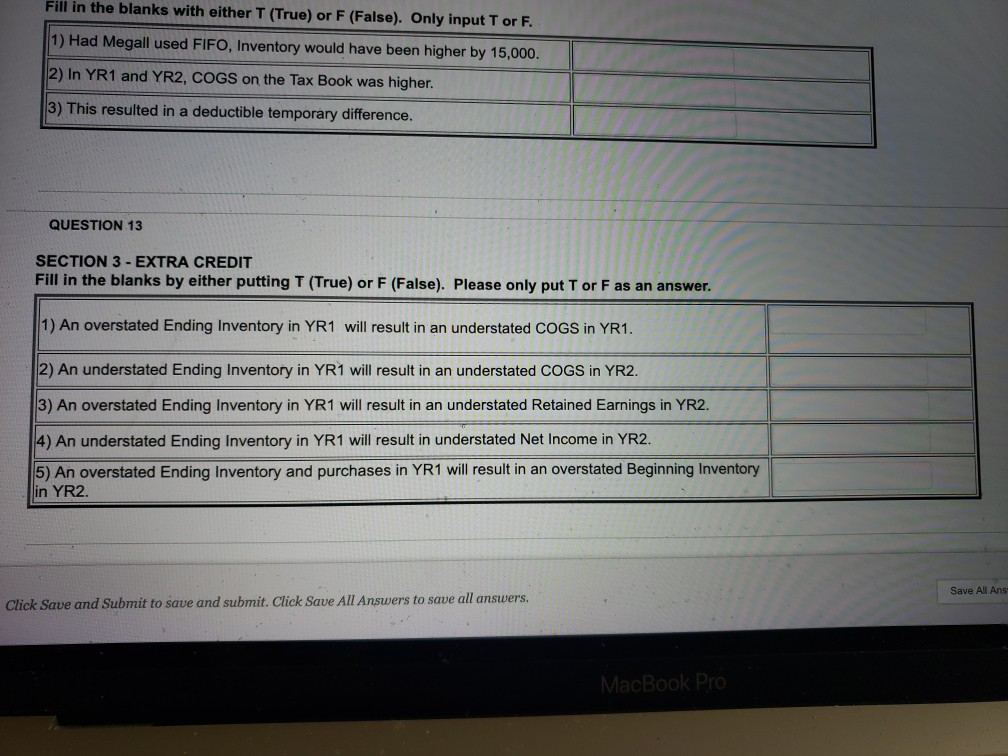

Remaining Time: 1 hour, 24 minutes, 39 seconds. Question Completion Status: VULO TUNT 6 points (Extra Cred SECTION 3 - Q1 The Drew Company purchases a $100,000 fixed asset on January 1, YR8. The asset has a useful life of 5 years with a $10,000 net salvage value. Drew depreciates this asset on Dec. 31 of each year. For two years, Drew uses the sum of the years' digits method of depreciation, but on January 1, YR10, it changes to the straight-line method of depreciation. No other estimates changed. What would be the total R/E amount to restate as of Jan. 1, YR10? QUESTION 12 12 p Megall Company began operations on Jan. 1, YR1. For tax purposes, Megall has always used FIFO method of inventory method, and will continue to do so. For financial reporting purpose, Megall has used LIFO. During YR3, Megall decides to change from the LIFO to the FIFO method of inventory valuation. Had Megall always used the FIFO method, COGS would have been lower by $25,000 in YR1 and lower by $35,000 in YR2. The tax rate is 35% every year. Prepare the necessary journal entry Megall will record in YR3 when it changes from the LIFO to the FIFO method. SECTION 3 - Q2 Fill in the blanks with either T (True) or F (False). Only input T or F. 1) Had Megall used FIFO, Inventory would have been higher by 15,000. 2) In YR1 and YR2, COGS on the Tax Book was higher. 3) This resulted in a deductible temporary difference. Save All Answers Close Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro Fill in the blanks with either T (True) or F (False). Only input T or F. 1) Had Megall used FIFO, Inventory would have been higher by 15,000. 2) In YR1 and YR2, COGS on the Tax Book was higher. 3) This resulted in a deductible temporary difference. QUESTION 13 SECTION 3 - EXTRA CREDIT Fill in the blanks by either putting T (True) or F (False). Please only put Tor F as an answer. 1) An overstated Ending Inventory in YR1 will result in an understated COGS in YR1. 2) An understated Ending Inventory in YR1 will result in an understated COGS in YR2. 3) An overstated Ending Inventory in YR1 will result in an understated Retained Earnings in YR2. 4) An understated Ending Inventory in YR1 will result in understated Net Income in YR2. 5) An overstated Ending Inventory and purchases in YR1 will result in an overstated Beginning Inventory in YR2. Save All Ans Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts