Question: Remaining Time: 1 hour 55 minutes, 58 seconds. Question Completion Status: 17 18 19 20 21 22 23 12 24 25 26 : 27 28

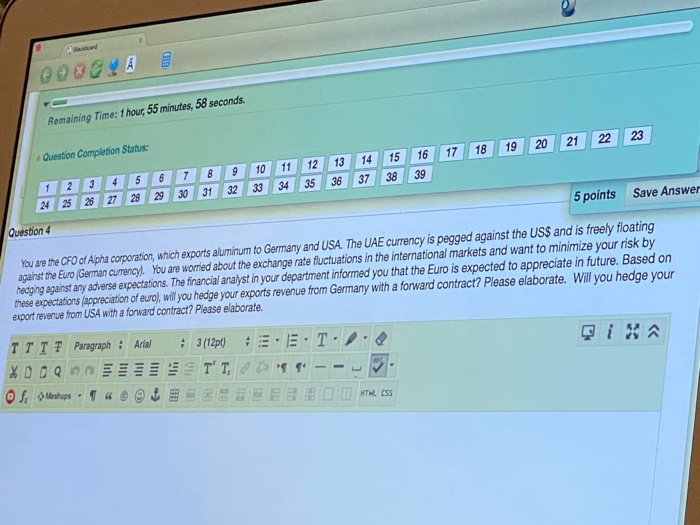

Remaining Time: 1 hour 55 minutes, 58 seconds. Question Completion Status: 17 18 19 20 21 22 23 12 24 25 26 : 27 28 29 30 31 32 33 34 35 5 0 ? 8 9 10 11 12 13 36 14 37 15 16 38 39 5 points Save Answe Question 4 You are the CFO of Apha corporation, which exports auminum to Germany and USA. The UAE currency is pegged against the US$ and is freely floating against the Euro German currency. You are worried about the exchange rate fluctuations in the international markets and want to minimize your risk by hodging against any adverse expectations. The financial analyst in your department informed you that the Euro is expected to appreciate in future. Based on these expectations appreciation of euro), will you hedge your exports revenue from Germany with a forward contract? Please elaborate. Will you hedge your export revenue from USA with a forward contract? Please elaborate. T TIF Paragraph : Arial X00Q Of Mastups - 4 E 3(12pt) E.T. TT, 25 of gr --- EEEEEEE ONTKESS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts