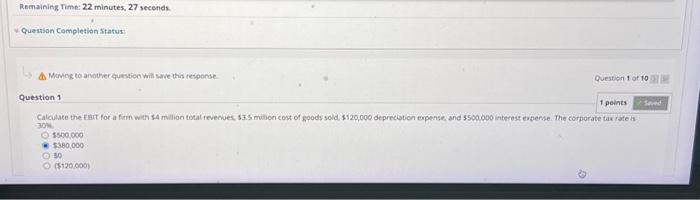

Question: Remaining Time: 22 minutes, 27 seconds. Question Completion Status: Moving to another question will save this response Question 1 Question 1 of 10 1

Remaining Time: 22 minutes, 27 seconds. Question Completion Status: Moving to another question will save this response Question 1 Question 1 of 10 1 points Calculate the EBIT for a firm with $4 million total revenues, $3.5 million cost of goods sold, $120,000 depreciation expense, and $500,000 interest expense. The corporate tax rate is 30% $500,000 $380,000 - 50 ($120,000) Seved

Step by Step Solution

There are 3 Steps involved in it

The question you presented asks to calculate the EBIT for a firm with given fina... View full answer

Get step-by-step solutions from verified subject matter experts