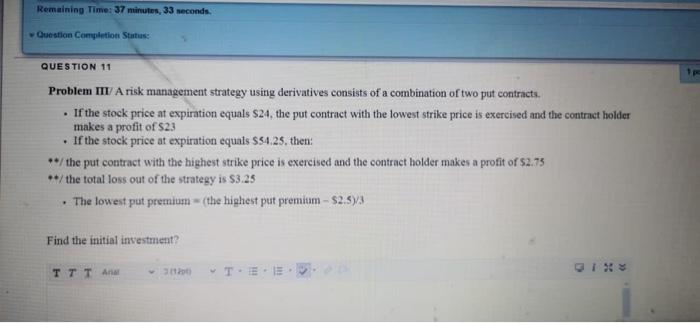

Question: Remaining Time: 37 minutes, 33 seconds Question Completion Status: QUESTION 11 Problem I/A risk management strategy using derivatives consists of a combination of two put

Remaining Time: 37 minutes, 33 seconds Question Completion Status: QUESTION 11 Problem I/A risk management strategy using derivatives consists of a combination of two put contracts. If the stock price at expiration equals $24. the put contract with the lowest strike price is exercised and the contract holder makes a profit of $23 . If the stock price at expiration equats $54.25. then: ** the put contract with the highest strike price is exercised and the contract holder makes a profit of $2.75 **/ the total loss out of the strategy is $3.25 The lowest put premium (the highest put premium - $2.53 Find the initial investment? 22 Question Completion Status: . The lowest put premium = (the highest put premium - $2.5y3 Find the initial investment? TT T Arial 3 (120) T.EE Path: Wo Question Completion Status: QUESTION 12 Find the lowest strike price? TTT Anal (12p01 T. We Path:p QUESTION 13 Find the highest strike price? TT T Aria 3 (121) T- 25 Path Path:p QUESTION 14 Find the lowest premium price? TTT Anal 312pt) T. III Pathp Path:p QUESTION 15 Find the highest premium price? TTT Anal 3 (12pt; T.EE . Path Pathp QUESTION 16 Find the breakeven price using the formula with the highest strike price? Anal 31200 TEE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts