Question: Remaining Time: 57 minutes, 07 seconds. Question Completion Status: At the end of its first year of operations on December 31, 2020, the Mojave

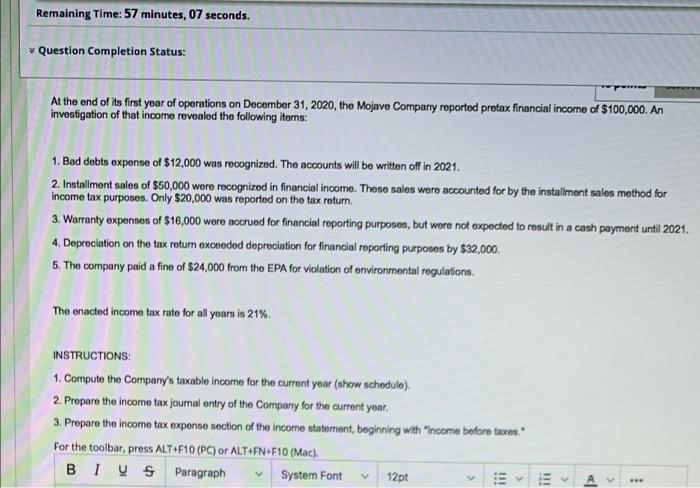

Remaining Time: 57 minutes, 07 seconds. Question Completion Status: At the end of its first year of operations on December 31, 2020, the Mojave Company reported pretax financial income of $100,000. An investigation of that income revealed the following items: 1. Bad debts expense of $12,000 was recognized. The accounts will be written off in 2021. 2. Installment sales of $50,000 were recognized in financial income. These sales were accounted for by the installment sales method for income tax purposes. Only $20,000 was reported on the tax return. 3. Warranty expenses of $16,000 were accrued for financial reporting purposes, but were not expected to result in a cash payment until 2021. 4. Depreciation on the tax return exceeded depreciation for financial reporting purposes by $32,000. 5. The company paid a fine of $24,000 from the EPA for violation of environmental regulations. The enacted income tax rate for all years is 21%. INSTRUCTIONS: 1. Compute the Company's taxable income for the current year (show schedule). 2. Prepare the income tax journal entry of the Company for the current year. 3. Prepare the income tax expense section of the income statement, beginning with "Income before taxes." For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph System Font 12pt !!! > < E < www

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts