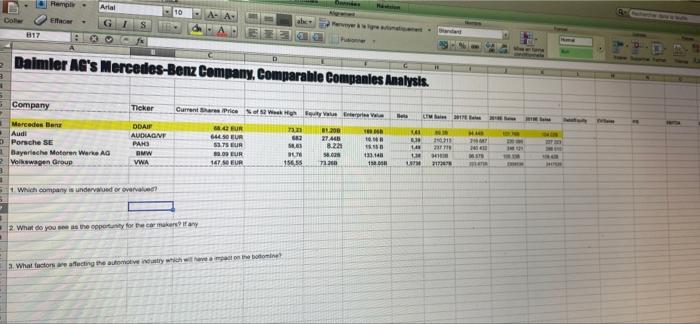

Question: Remple - Arial Coller Etc G 817 . Daimler AG's Mercedes-Benz Company, Comparable Companies Analysis. a 1 5 Company Ticker CIMDI Mercedes Benu Audi Porsche

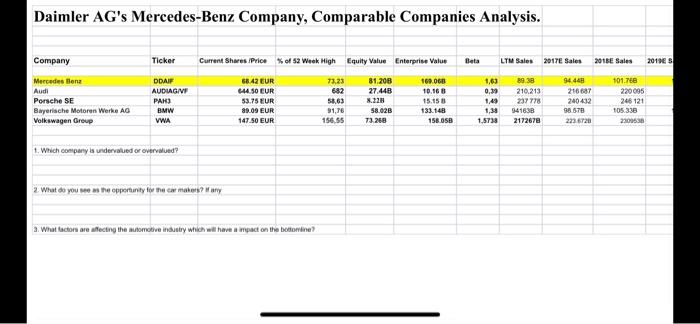

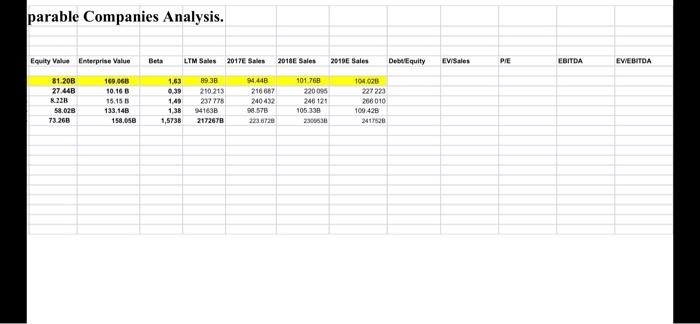

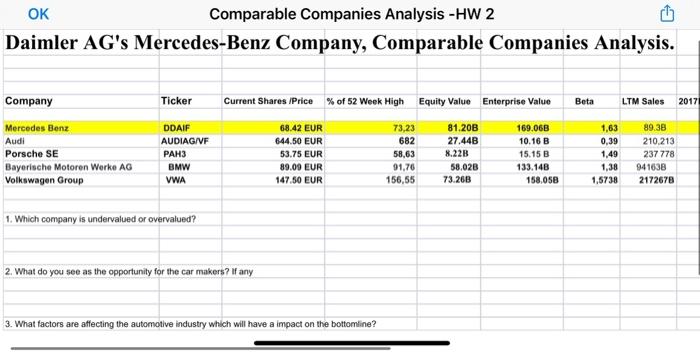

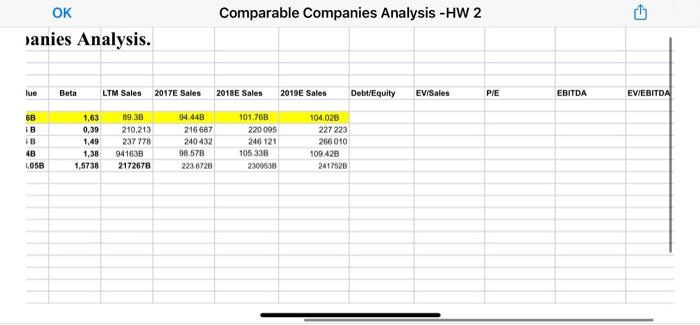

Remple - Arial Coller Etc G 817 . Daimler AG's Mercedes-Benz Company, Comparable Companies Analysis. a 1 5 Company Ticker CIMDI Mercedes Benu Audi Porsche SE Bayerische Motoren Werke AG Volkswagen Group DDA AUDHAON PANG BMW VWA Current Bare Price of share FUR 1.200 TEM 64450 EUR 62 27.466 53.75 EUR S8 8.22 1.09 EUR . 33.14 147 EUR 15656 71.200 1. HO r IM 1 Which company is underwood or overval 2. What do you the opportunity for the makers ar a. What factors are affecting the automotive in which on the boot Daimler AG's Mercedes-Benz Company, Comparable Companies Analysis. Company Ticker Beta LTM Sales 2017 Sales 2013 Sales 2010ES 10.30 Mercedes Bena Audi Porsche SE Bayerische Motoren Werke AG Volkswagen Group 163 0,39 DDAF AUDIAGA PAN) BMW WWA Current Shares Price % of 52 Week High Equity Value Enterprise Valur 68.42 EUR 73.23 81.206 1600GB 644.50 EUR 682 27.44B 10.16 53.75 EUR 58,63 1.328 15.15 89.09 EUR 91,76 58.02B 133.14 147.50 EUR 156,55 73.268 158 OSB 1.49 94.448 216GBT 240432 98.578 223 6720 210.213 237778 941638 2172678 101760 220095 246 121 105.338 2203638 1,30 1,5738 1. Which company is undervalued or overved? 2. What do you see as the opportunity for the car takes? Many 2. What factors are affecting the automotive industry which will have an impact on the bottomline? parable Companies Analysis. Equity Value Enterprise Value Beta LTM Sales 2017 Sales 2018E Sales 2010E Sales Debt Equity EV/Sales PIE EBITDA EWEBITDA 81.203 27.440 8228 58.028 73.268 160.068 10.16 15.15 133.148 158.05B 1,69 0.39 1,40 1,38 1,5738 19.30 210.213 237 778 941638 2172878 94.440 216 687 240432 s. 570 223.6720 101768 220 096 246.125 106 338 2300530 104.00 227 223 206010 100 428 2417526 OK Comparable Companies Analysis -HW 2 Daimler AG's Mercedes-Benz Company, Comparable Companies Analysis. Company Ticker Current Shares /Price% of 52 Week High Equity Value Enterprise Value Beta LTM Sales 2017 1,63 Mercedes Benz Audi Porsche SE Bayerische Motoren Werke AG Volkswagen Group DDAIF AUDIAG/VF PAH3 BMW VWA 68.42 EUR 644.50 EUR 53.75 EUR 89.09 EUR 147.50 EUR 73,23 682 58,63 91.76 156,55 81.203 27.44B 8.22B 58.02B 73.26B 169.06B 10.16 B 15.15 B 133.14B 158.05B 0,39 1,49 1,38 1,5738 89.38 210.213 237 778 941638 2172678 1. Which company is undervalued or overvalued? 2. What do you see as the opportunity for the car makers? If any 3. What factors are affecting the automotive industry which will have a impact on the bottomline? Comparable Companies Analysis -HW 2 G OK Danies Analysis. lue Beta LTM Sales 2017E Sales 2018 E Sales 2019E Sales Debt/Equity EV/Sales PIE EBITDA EVEBITDA 6B IB 48 1,058 1,63 0,39 1,49 1,38 1,5738 89.38 210.213 237 778 941630 2172678 94.44B 216 687 240 432 98 578 223 6720 101.76B 220 095 246 121 105 338 23095:38 104.028 227 223 266 010 109.428 2417520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts