Question: Rental losses can be offset ( within a limit ) against ordinary / portfolio income on active participation by a tax payer. This can be

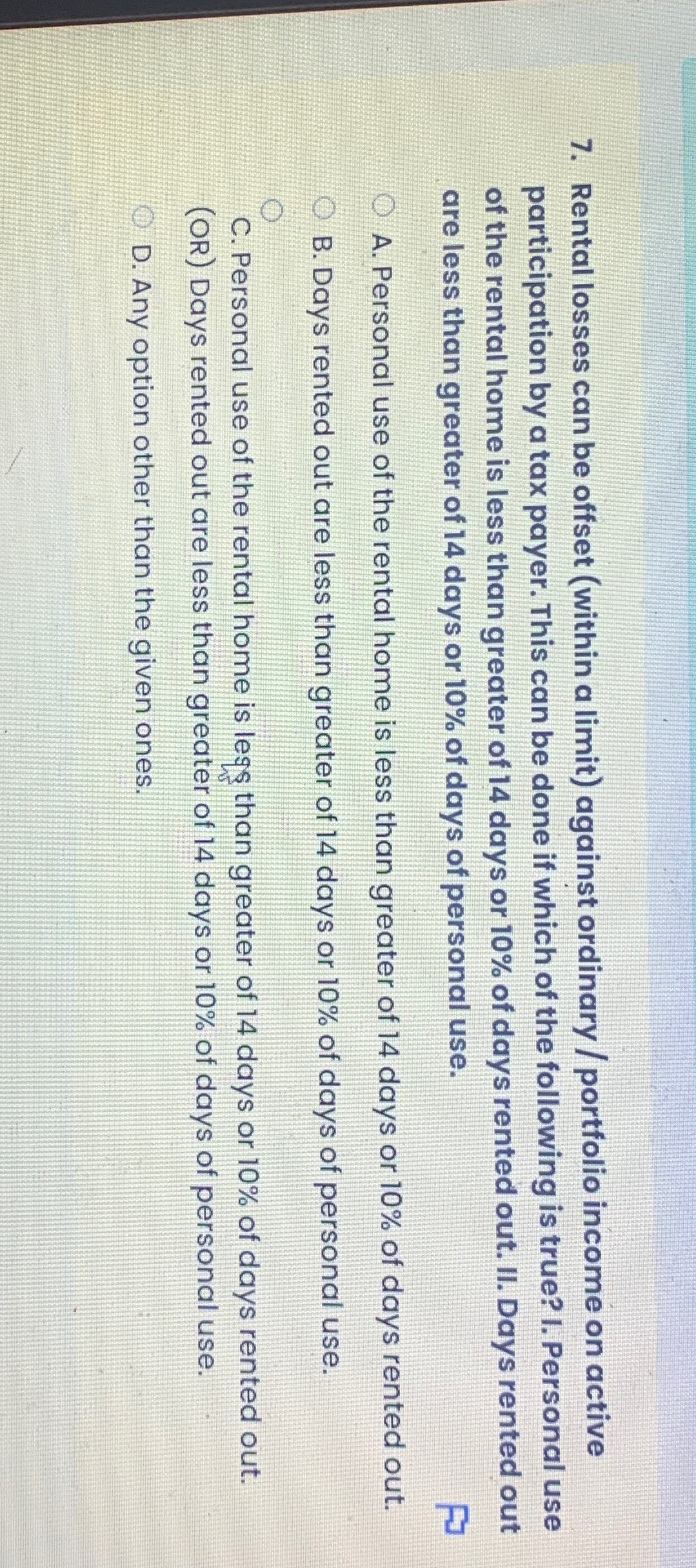

Rental losses can be offset within a limit against ordinary portfolio income on active participation by a tax payer. This can be done if which of the following is true? I. Personal use of the rental home is less than greater of days or of days rented out. II Days rented out are less than greater of days or of days of personal use.

A Personal use of the rental home is less than greater of days or of days rented out.

B Days rented out are less than greater of days or of days of personal use.

C Personal use of the rental home is less than greater of days or of days rented out.

OR Days rented out are less than greater of days or of days of personal use.

D Any option other than the given ones.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock