Question: Repair, Retain, or Replace Equipment LEARNING OBJECTIVE 5 Analyze the relevant costs to be considered in repairing, retaining, or replacing equipment. Illustration: Jeffcoat Company has

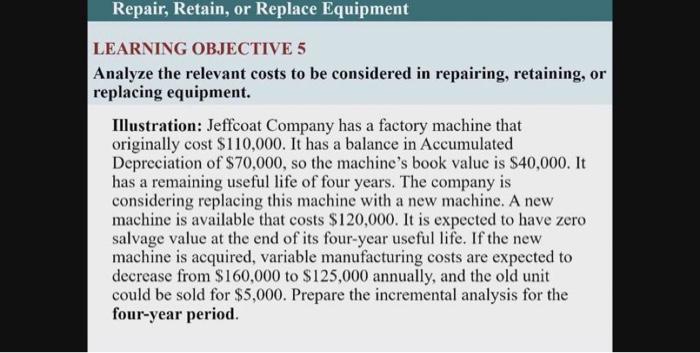

Repair, Retain, or Replace Equipment LEARNING OBJECTIVE 5 Analyze the relevant costs to be considered in repairing, retaining, or replacing equipment. Illustration: Jeffcoat Company has a factory machine that originally cost $110,000. It has a balance in Accumulated Depreciation of $70,000, so the machine's book value is $40,000. It has a remaining useful life of four years. The company is considering replacing this machine with a new machine. A new machine is available that costs $120,000. It is expected to have zero salvage value at the end of its four-year useful life. If the new machine is acquired, variable manufacturing costs are expected to decrease from $160,000 to $125,000 annually, and the old unit could be sold for $5,000. Prepare the incremental analysis for the four-year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts