Question: Replacement analysis: A manager is contemplating replacing an existing machine with a new machine. The cost of new machine, including installation cost is Rs 3

Replacement analysis:

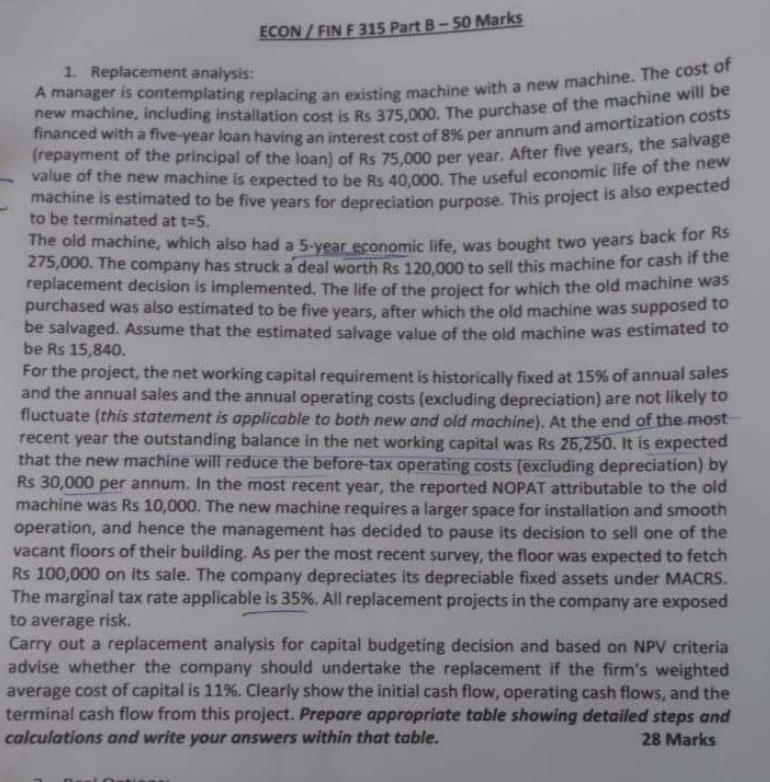

A manager is contemplating replacing an existing machine with a new machine. The cost of

new machine, including installation cost is Rs The purchase of the machine will be

financed with a fiveyear loan having an interest cost of per annum and amortization costs

repayment of the principal of the loan of Rs per year. After five years, the salvage

value of the new machine is expected to be Rs The useful economic life of the new

machine is estimated to be five years for depreciation purpose. This project is also expected

to be terminated at

The old machine, which also had a year economic life, was bought two years back for Rs

The company has struck a deal worth Rs to sell this machine for cash if the

replacement decision is implemented. The life of the project for which the old machine was

purchased was also estimated to be five years, after which the old machine was supposed to

be salvaged. Assume that the estimated salvage value of the old machine was estimated to

be Rs

For the project, the net working capital requirement is historically fixed at of annual sales

and the annual sales and the annual operating costs excluding depreciation are not likely to

fluctuate this statement is applicable to both new and old machine At the end of the most

recent year the outstanding balance in the net working capital was Rs It is expected

that the new machine will reduce the beforetax operating costs excluding depreciation by

Rs per annum. In the most recent year, the reported NOPAT attributable to the old

machine was Rs The new machine requires a larger space for installation and smooth

operation, and hence the management has decided to pause its decision to sell one of the

vacant floors of their bullding. As per the most recent survey, the floor was expected to fetch

Rs on its sale. The company depreciates its depreciable fixed assets under MACRS.

The marginal tax rate applicable is All replacement projects in the company are exposed

to average risk.

Carry out a replacement analysis for capital budgeting decision and based on NPV criteria

advise whether the company should undertake the replacement if the firm's weighted

average cost of capital is Clearly show the initial cash flow, operating cash flows, and the

terminal cash flow from this project. Prepare appropriate table showing detailed steps and

calculations and write your answers within that table.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock