Question: Replacement decision A. Also called a firm's hurdle rate, it is used as the discount rate in a firm's net present value (NPV) calculations or

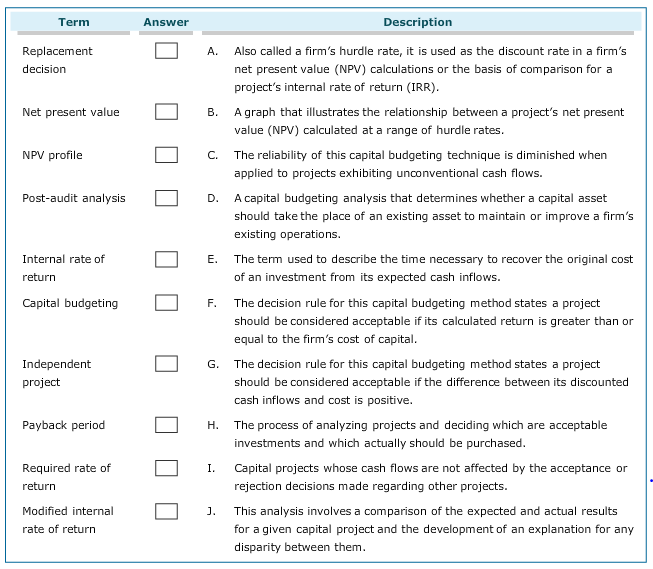

Replacement decision A. Also called a firm's hurdle rate, it is used as the discount rate in a firm's net present value (NPV) calculations or the basis of comparison for a project's internal rate of return (IRR) Net present Value B. A graph that illustrates the relationship between a project's net present value (NPV) calculated at a range of hurdle rates. NPV profile C. The reliability of this capital budgeting technique is diminshed when applied to projects exhibiting unconventional cash flows. Post-audit analysis D. A capital budgeting analysis that determines whether a capital asset should take the place of an existing asset to maintain or improve a firm's existing operations.Internal rate of return E. The term used to describe the time necessary to recover the original cost of an investment from its expected cash inflows. Capital budgeting F. The decision rule for this capital budgeting method states a project sholud be consiered acceptable if its caluculted return is greater than or equal to the firm's cost of capital. Independent project G. The decision rule for this capital budgeting method states a project should be considered acceptable if the difference betwwen its discounted cahs inflows and cost is posititive Payback Period H. The process of analyzing projecs and deciding which are acceptable investements and which actually should be purchased Required rate of return I. Capital projects whose cash flos are not affected by the acceptance or rejection decisions made regarding other projects. Modified internal rate of return J. This analysis involeves a comparison of the expected and actual results for a given capital project and the development of an explanatin for any disparity between them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts