Question: Reporting Using the FSET and Preparing Journal Entries and the General Ledger Assume that the following accounts appear in the ledger of M . E

Reporting Using the FSET and Preparing Journal Entries and the General Ledger

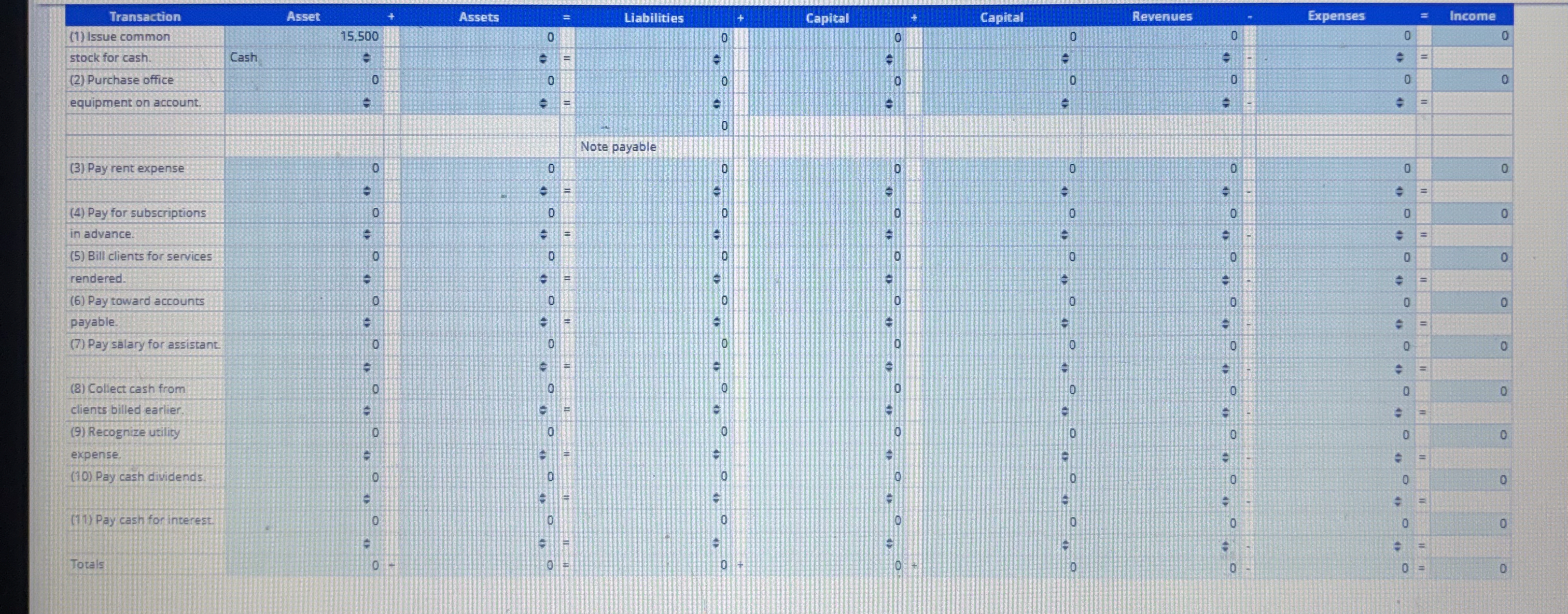

Assume that the following accounts appear in the ledger of ME Carter, a financial consultant to companies in the retail sector. Cash; Accounts Receivable; Office Equipment; Prepaid Subscriptions; Accounts Payable; Note Payable; Common Stock; Retained Earnings; Fees Earned; Salaries Expense; Rent Expense; Interest Expense; and Utilities Expense. ME Carter had the following transactions:

ME Carter started the firm by contributing $ cash to the business in exchange for common stock.

The firm purchased $ in office equipment, issuing a longterm note payable for $ with the remainder on account.

Paid $ cash for this period's office rent on a shortterm lease

Paid $ cash for subscriptions to online financial databases covering the next three periods.

Billed clients $ for services rendered.

Made $ cash payment on account for the equipment purchased in transaction

Paid $ cash for assistant's salary for this period.

Collected $ cash from clients previously billed in transaction

Received $ invoice for this period's utilities; it is paid early in the next period.

Paid $ cash for dividends to shareholders.

Paid $ cash.for interest on the note payable for the period.

Analyze and enter ech into the financial statement effects template.

Note: For each account category, indicate the appropriate account name. Enter NA for any account category that is not used for a given transaction.

Note: Indicate a decrease in an account category by including a negative sign with the amount.

I have attached a template of the ledger Thanks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock