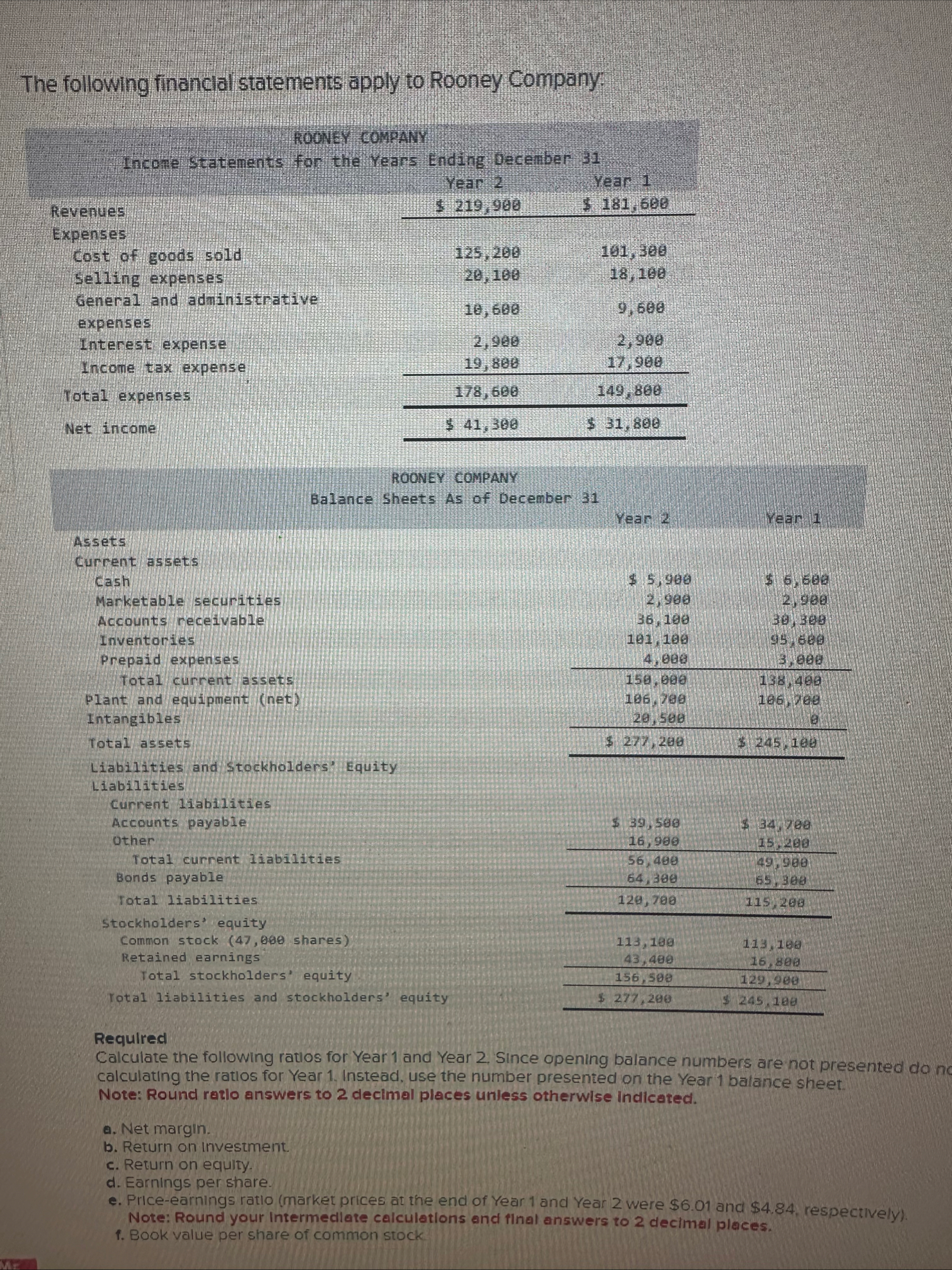

Question: Requiled Calculate the following ratios for Year 1 and Year 2 Since opening balance numbers calculating the ratios for Year 1 . Instead, use the

Requiled

Calculate the following ratios for Year and Year Since opening balance numbers calculating the ratios for Year Instead, use the number presented on the Year bal Note: Round ratlo answers to decimal places uniess otherwise Indicated.

a Net margin.

b Return on Investment.

c Return on equity.

d Earnings per share.

e Priceearnings ratio market prices at the end of Year and Year were $ and Note: Round your intermediate calculations and final answers to decimal place

f Book value per share of common stock.

g Times interest earned.

h Working capital.

I. Current ratio.

J Quick acidtest ratio.

k Accounts recelvable turnover.

I. Inventory turnover.

m Debttoequity ratlo.

n Debttoassets ratlo.

Note: Round your answers to the nearest whole percent.

tableYear Year a Net margin,,b Return on investment,,c Return on equity,,d Earnings per share,,,,e Priceearnings ratio,,times,,f Book value per share of common stock,,times,,times Times interest earned,,times,,h Working capital,$ timesi Current ratio,,,$ i Quick acidtest ratio,. k Accounts receivable turnover,,,, Inventory turnover,,times,,timesm Debttoequity ratio,,times,,timesn Debtroassets ratio,,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock