Question: Required 1. By looking at the financial statements provided would you say the management is doing a 'good job' in managing the company ? justify

Required

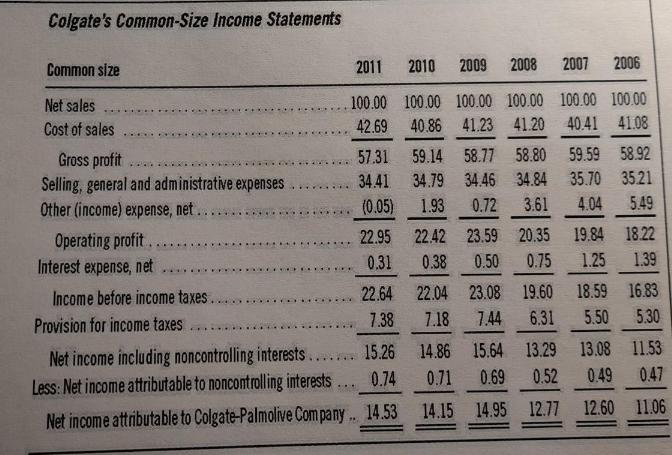

1. By looking at the financial statements provided would you say the management is doing a 'good job' in managing the company ? justify your answer

2. Would you invest in this Company after looking at the financial statements?

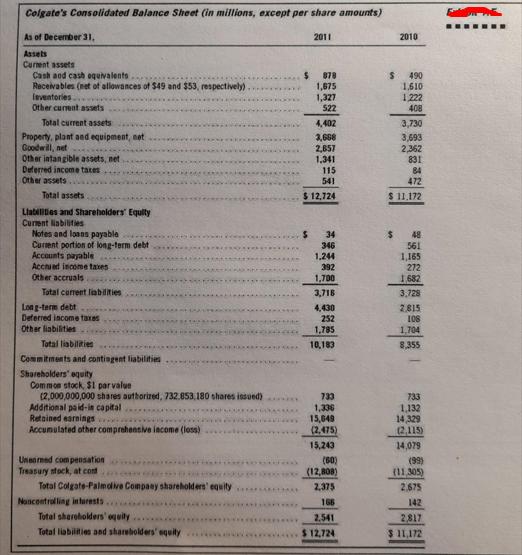

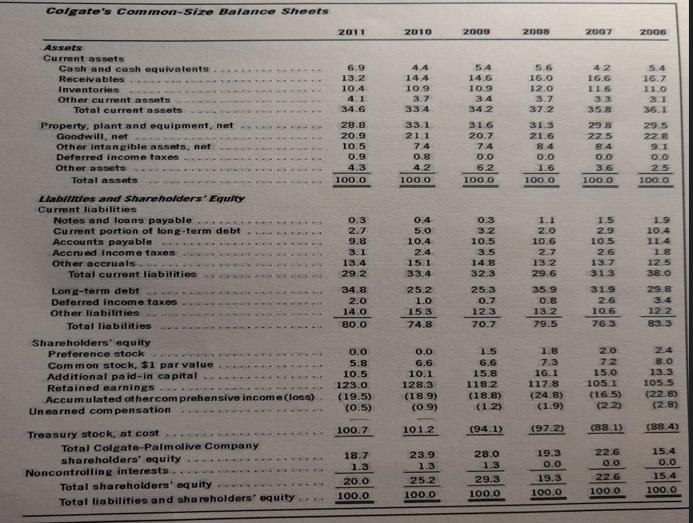

Colgate's Consolidated Balance Sheet (in millions, except per share amounts) 2011 As of December 31, Assets Current assets Cash and cash oquivalents Receivables (net of allowances of $49 and $53, respectively) leventories.... Other current assets Total current assets Property, plant and equipment, net Goodwill, net - Other intangible assets, net Deferred income taxes Other assets.. Total assets. Liabilities and Shareholders' Equity Current liabilities Notes and loans payable Current portion of long-term debt- Accounts payable Accrued income taxes Other accruals Total current liabilities Long-term debt Deferred income taxes Other liabilities Total liabilities Commitments and contingent liabilities Shareholders' equity Common stock, $1 par value (2,000,000,000 shares authorized, 732.853,180 shares issued) Additional paid-in capital Retained earnings i Accumulated other comprehensive income (loss) Unearmed compensation Treasury stock, at com Total Colgate-Palmolive Company shareholders' equity Nuncontrolling interests Total shareholders' equity Total liabilities and shareholders' equity $ 878 1,675 1,327 $ 522 4,402 3,668 2,657 1,341 115 541 $ 12,724 34 346 1,244 392 1,700 3,718 4,430 252 Oxan 1,785 10,183 733 1,336 15,049 (2,475) 15,243 (60) (12,808) 2,375 166 2.541 $12,724 $ 2010 $ 490 1,610 1,222 408 3,730 3,693 2,362 831 84 472 $ 11,172 48 561 1,165 272 1,682 3,728 2,815 108 1,704 8,355 733 1,132 14,329 (2,115) 14,079 (99) (11,305) 2.675 142 2,817 $ 11,172

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

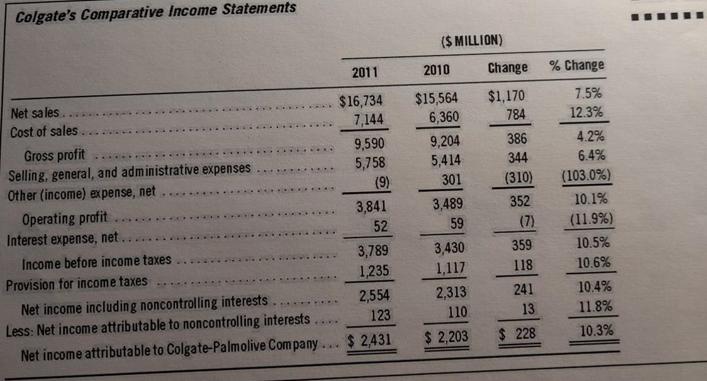

Based on the financial statements provided for ColgatePalmolive Company the management appears to be doing a good job in managing the company Here are ... View full answer

Get step-by-step solutions from verified subject matter experts