Question: Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense Building; Depreciation ExpenseEquipment; and

| Required: | |

|---|---|

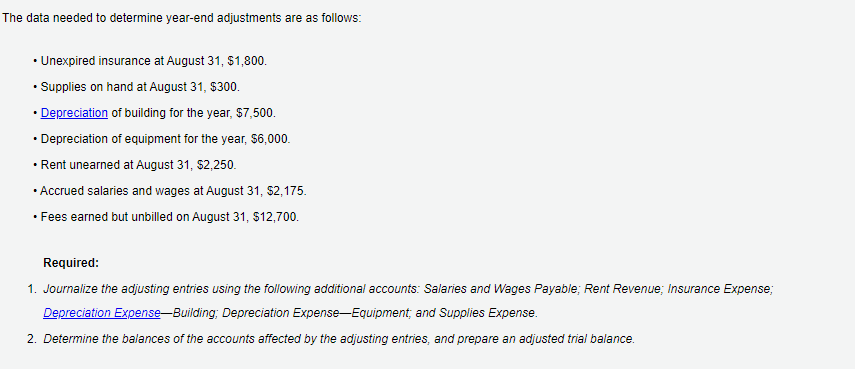

| 1. | Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. |

| 2. | Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance. |

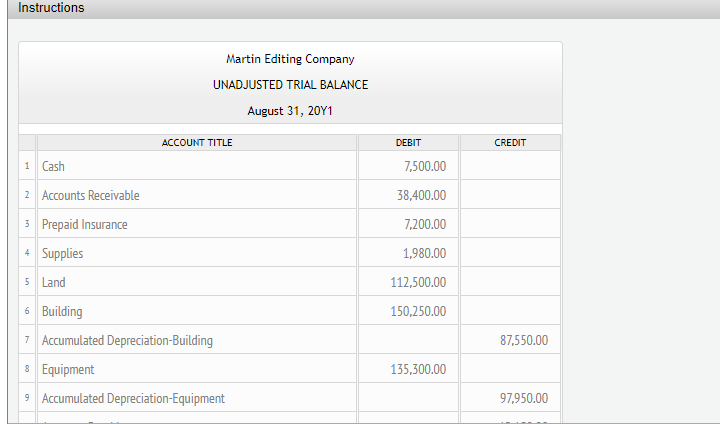

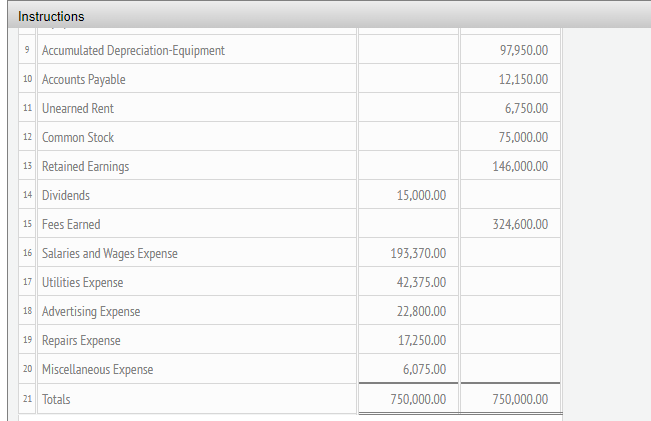

Instructions Martin Editing Company UNADJUSTED TRIAL BALANCE August 31, 20Y1 Instructions The data needed to determine year-end adjustments are as follows: - Unexpired insurance at August 31, $1,800. - Supplies on hand at August 31, $300. - Depreciation of building for the year, $7,500. - Depreciation of equipment for the year, $6,000. - Rent unearned at August 31, $2,250. - Accrued salaries and wages at August 31, \$2,175. - Fees earned but unbilled on August 31, $12,700. Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts