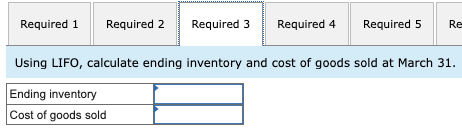

Question: Required 1 Required 2 Required 3 Required 4 Required 5 Re Using LIFO, calculate ending inventory and cost of goods sold at March 31.

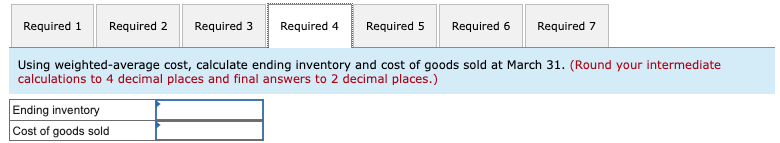

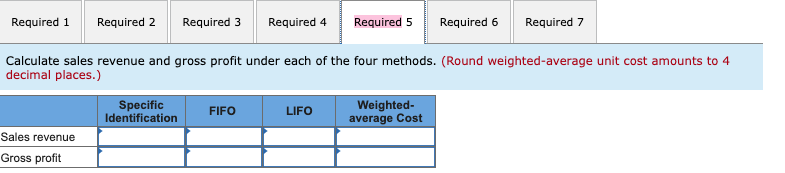

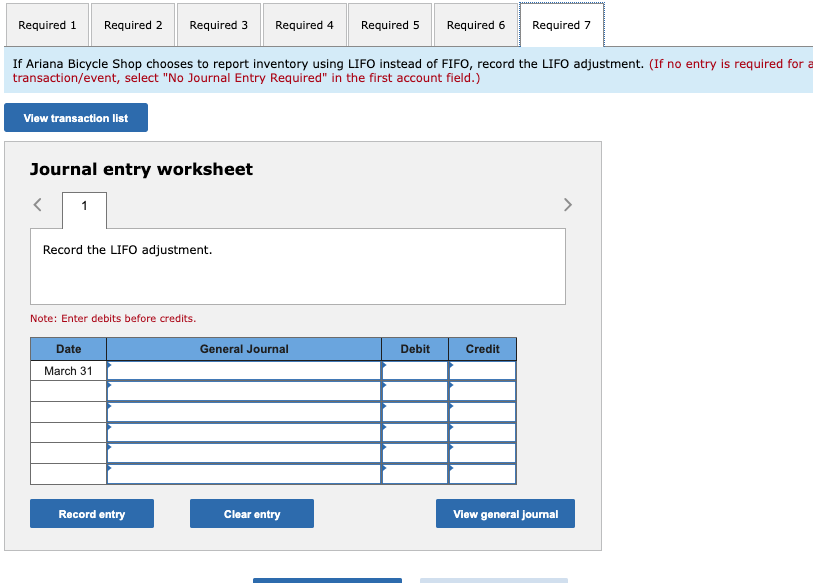

Required 1 Required 2 Required 3 Required 4 Required 5 Re Using LIFO, calculate ending inventory and cost of goods sold at March 31. Ending inventory Cost of goods sold Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Using weighted-average cost, calculate ending inventory and cost of goods sold at March 31. (Round your intermediate calculations to 4 decimal places and final answers to 2 decimal places.) Ending inventory Cost of goods sold Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average unit cost amounts to 4 decimal places.) Specific Identification FIFO LIFO Weighted- average Cost Sales revenue Gross profit Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 If Ariana Bicycle Shop chooses to report inventory using LIFO instead of FIFO, record the LIFO adjustment. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the LIFO adjustment. Note: Enter debits before credits. Date General Journal Debit Credit March 31 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts