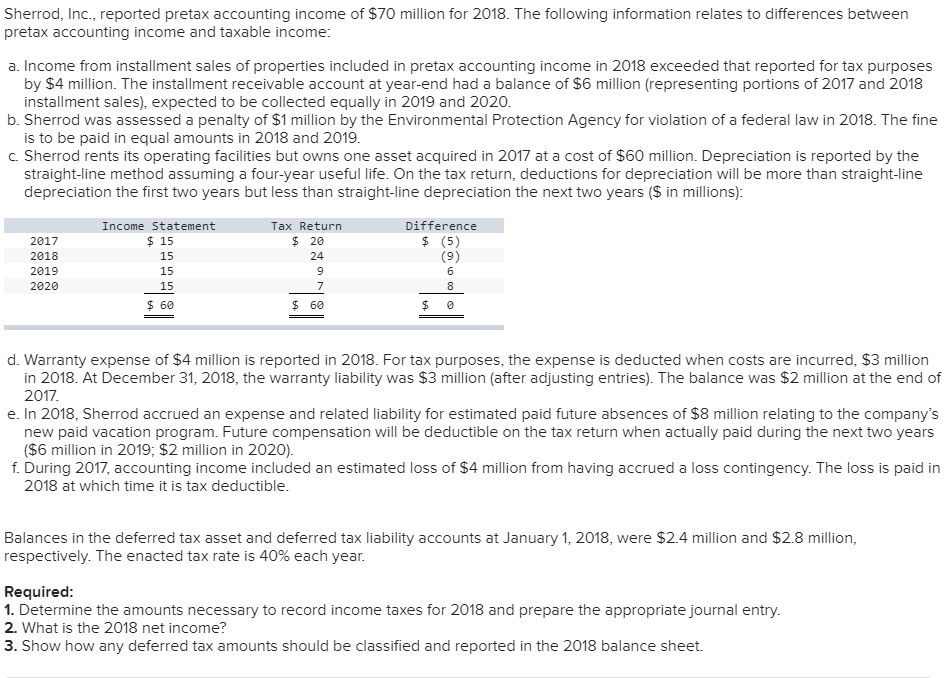

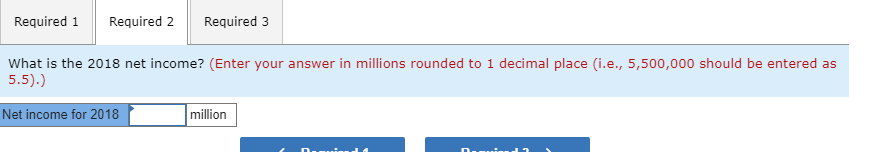

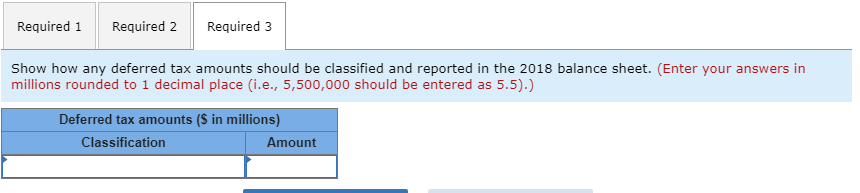

Question: Required 1 Required 2 Required 3 Show how any deferred tax amounts should be classified and reported in the 2018 balance sheet. (Enter your answers

Required 1 Required 2 Required 3 Show how any deferred tax amounts should be classified and reported in the 2018 balance sheet. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Deferred tax amounts (S in millions) Classification Amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock