Question: 1-3. Using the FIFO method, assign May's costs to the units transferred out and assign costs to its ending work in process inventory. (Round

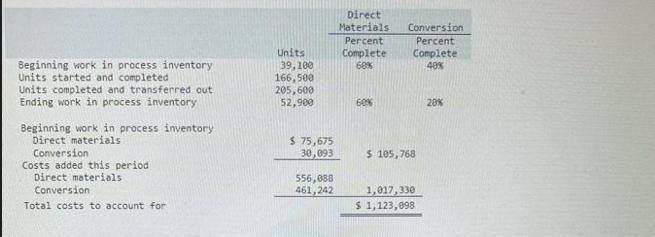

1-3. Using the FIFO method, assign May's costs to the units transferred out and assign costs to its ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Direct materials Conversion Costs added this period. Direct materials Conversion Total costs to account for Units 39,100 166,500 205,600 52,900 $ 75,675 30,093 556,088 461,242 Direct Materials Conversion Percent Complete 60% 60% Percent Complete 40% $ 105,768 1,017,330 $ 1,123,098 20%

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

ANSWER To calculate the cost per equivalent unit EUP we use the following formula Cost per EUP Costs ... View full answer

Get step-by-step solutions from verified subject matter experts