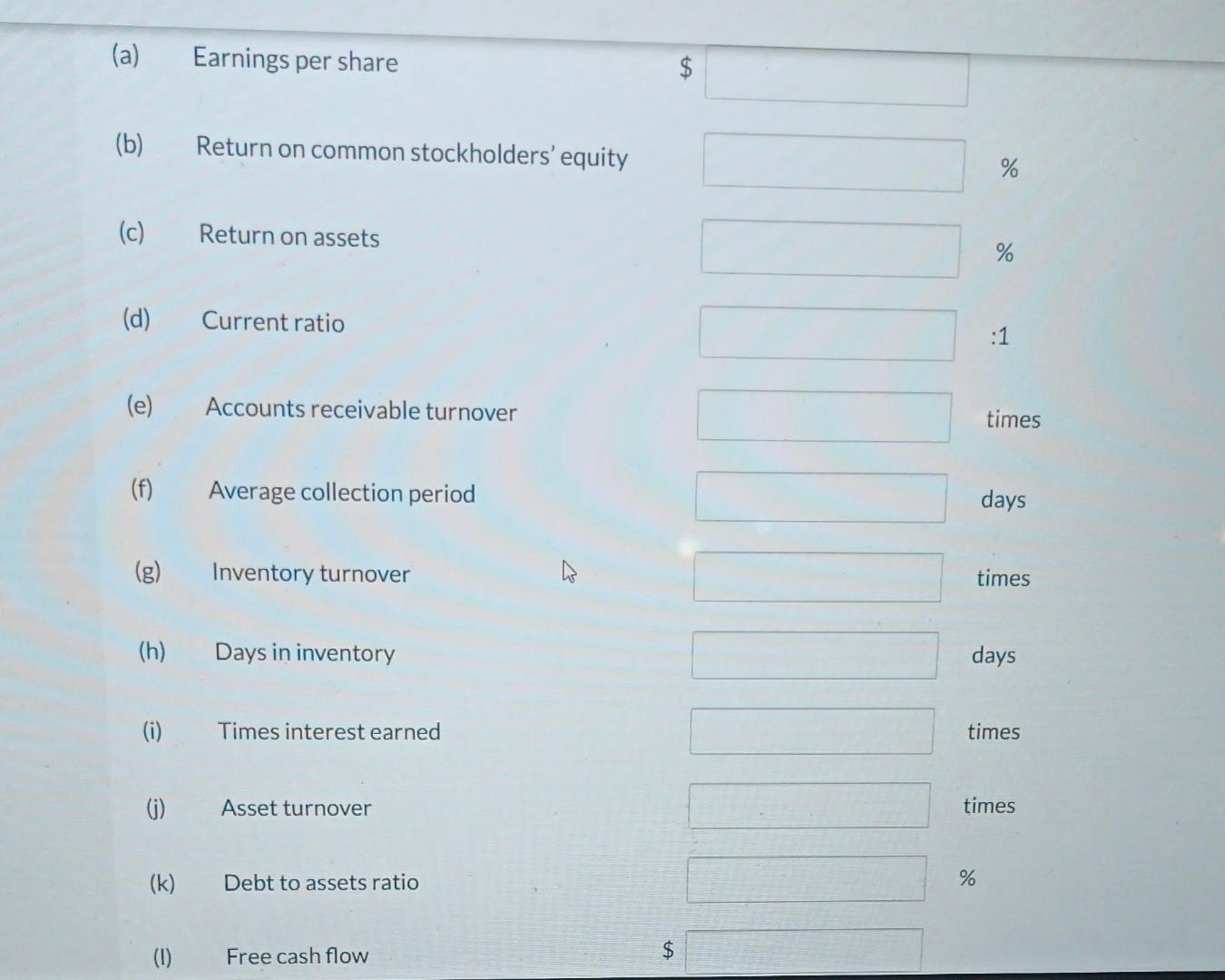

Question: (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (1) Earnings per share Return on common stockholders' equity Return on assets Current

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (1) Earnings per share Return on common stockholders' equity Return on assets Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory Times interest earned Asset turnover Debt to assets ratio Free cash flow $ tA % :1 times days times % days times times

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

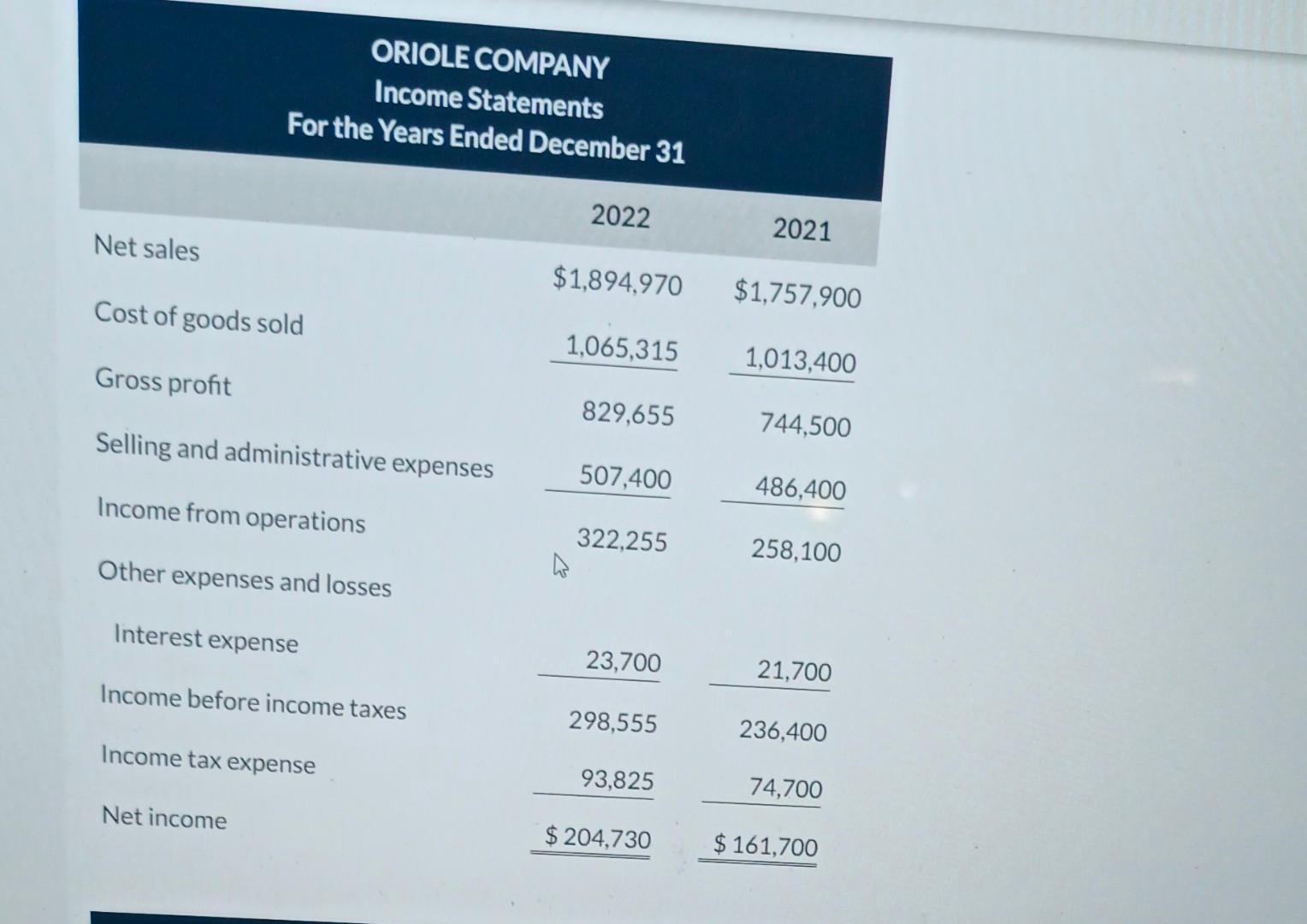

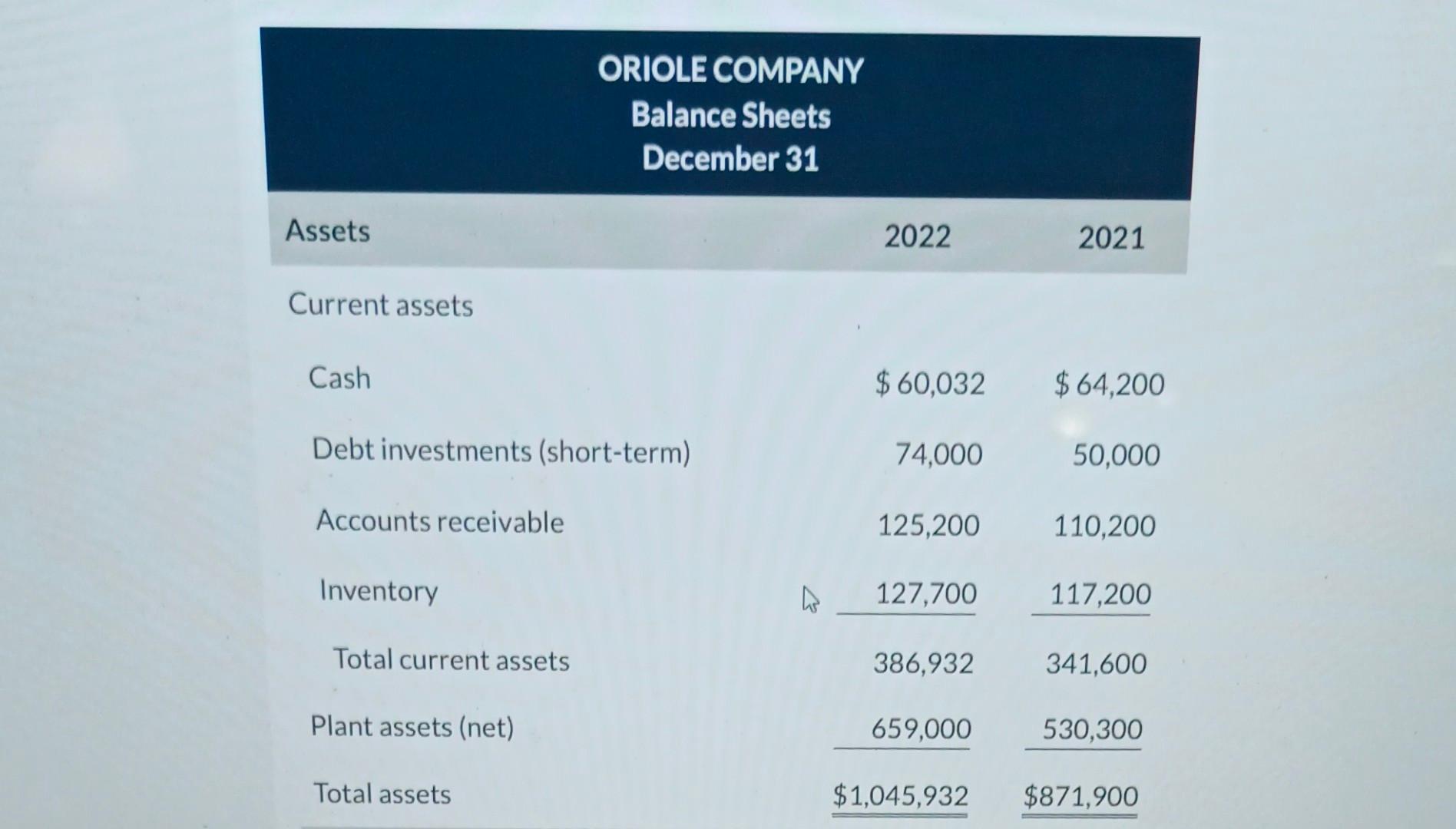

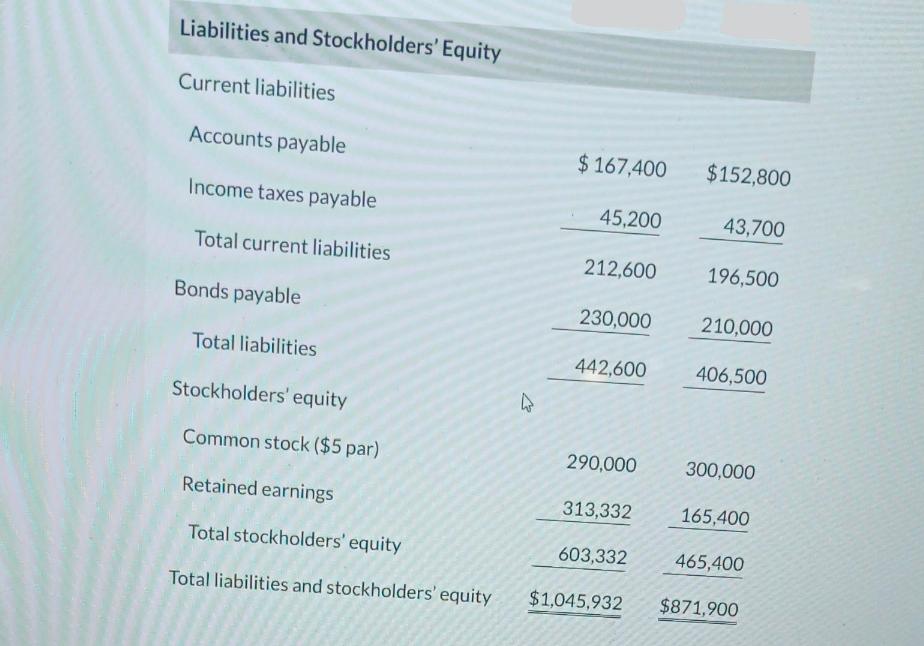

ORIOLE COMPANY Financial Analysis Profitability a Earnings per share EPS 2022 204730 net income 290000 shares 0706 2021 161700 net income 290000 share... View full answer

Get step-by-step solutions from verified subject matter experts