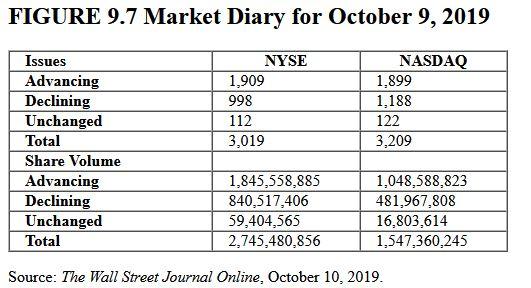

Question: Required: a. Calculate breadth for NASDAQ using the data in Figure 9.7. Advances Declines Net Advancing Breadth b. Is the signal bullish or bearish? O

Required: a. Calculate breadth for NASDAQ using the data in Figure 9.7. Advances Declines Net Advancing Breadth b. Is the signal bullish or bearish? O Bearish O Bullish FIGURE 9.7 Market Diary for October 9, 2019 NYSE 1,909 998 112 3,019 NASDAQ 1,899 1,188 122 3,209 Issues Advancing Declining Unchanged Total Share Volume Advancing Declining Unchanged Total 1,845,558,885 840,517,406 59,404,565 2,745,480,856 1,048,588,823 481,967,808 16,803,614 1,547,360,245 Source: The Wall Street Journal Online, October 10, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts