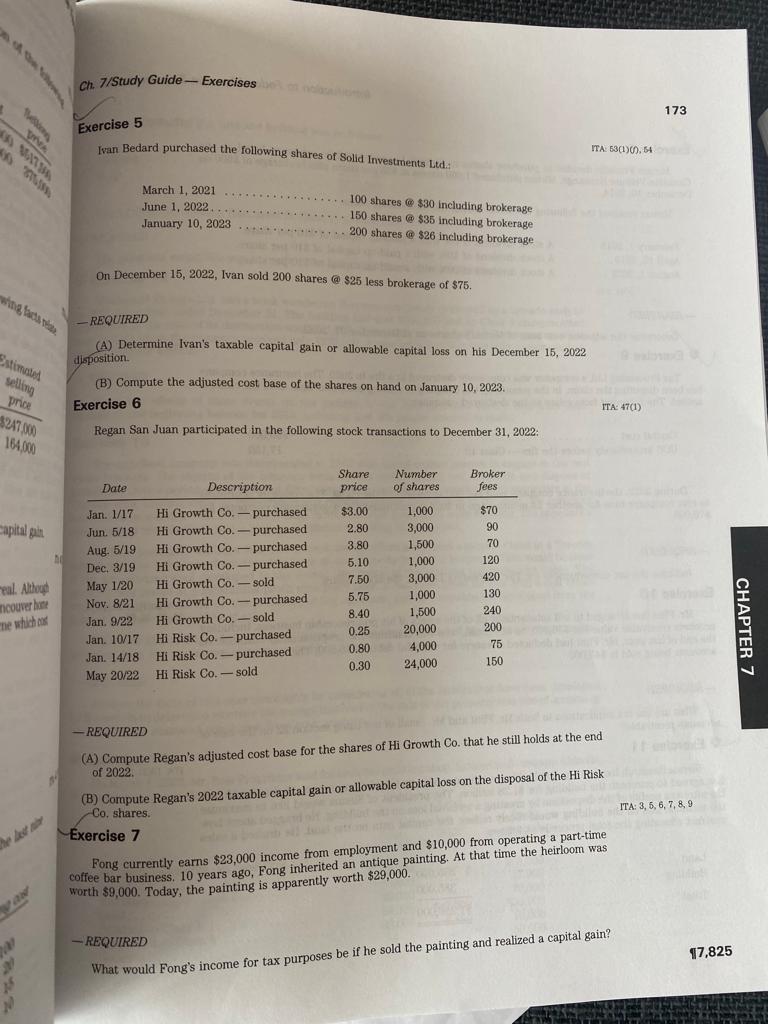

Question: - REQUIRED (A) Compute Regan's adjusted cost base for the shares of Hi Growth Co. that he still holds at the end of 2022 .

- REQUIRED (A) Compute Regan's adjusted cost base for the shares of Hi Growth Co. that he still holds at the end of 2022 . (B) Compute Regan's 2022 taxable capital gain or allowable capital loss on the disposal of the Hi Risk Co. shares. Exercise 7 Fong currently earns $23,000 income from employment and $10,000 from operating a part-time coffee bar business. 10 years ago, Fong inherited an antique painting. At that time the heirloom was worth $9,000. Today, the painting is apparently worth $29,000. - REQUIRED What would Fong's income for tax purposes be if he sold the painting and realized a capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts