Question: Required : a. Compute the gross estate . b. Compute the allowed deductions , taxable net estate and estate tax due . Problem 9 Mr.

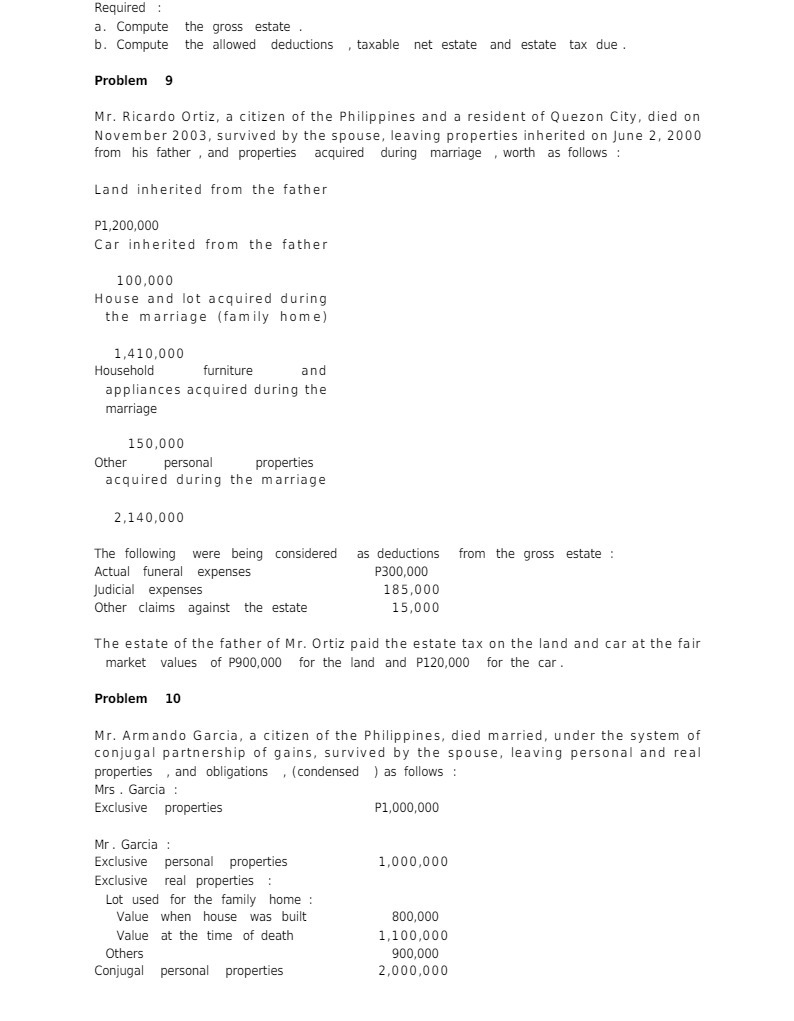

Required : a. Compute the gross estate . b. Compute the allowed deductions , taxable net estate and estate tax due . Problem 9 Mr. Ricardo Ortiz, a citizen of the Philippines and a resident of Quezon City, died on November 2003, survived by the spouse, leaving properties inherited on June 2, 2000 from his father , and properties acquired during marriage , worth as follows : Land inherited from the father P1,200,000 Car inherited from the father 100,000 House and lot acquired during the marriage (family home) 1,410,000 Household furniture and appliances acquired during the marriage 150,000 Other personal properties acquired during the marriage 2,140,000 The following were being considered as deductions from the gross estate : Actual funeral expenses P300,000 Judicial expenses 185,000 Other claims against the estate 15,000 The estate of the father of Mr. Ortiz paid the estate tax on the land and car at the fair market values of P900,000 for the land and P120,000 for the car . Problem 10 Mr. Armando Garcia, a citizen of the Philippines, died married, under the system of conjugal partnership of gains, survived by the spouse, leaving personal and real properties , and obligations , (condensed ) as follows : Mrs . Garcia : Exclusive properties P1,000,000 Mr . Garcia : Exclusive personal properties 1,000,000 Exclusive real properties Lot used for the family home : Value when house was built 800,000 Value at the time of death 1,100,000 Others 900,000 Conjugal personal properties 2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts