Question: REQUIRED a . Compute the PPE turnover for 2 0 2 0 . Assuming an average PPE turnover of 4 . 0 for the company's

REQUIRED

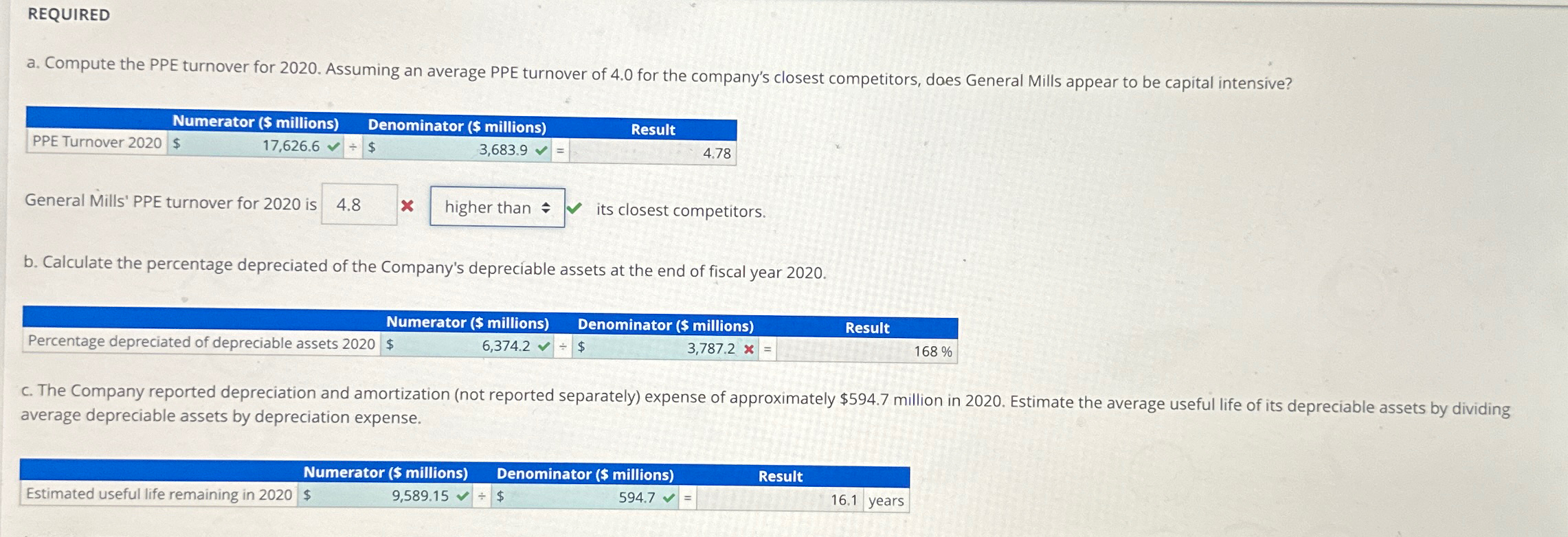

a Compute the PPE turnover for Assuming an average PPE turnover of for the company's closest competitors, does General Mills appear to be capital intensive?

tableNumerator $ millionsDenominator $ millionsResult,PPE Turnover $$

General Mills' PPE turnover for is its closest competitors.

b Calculate the percentage depreciated of the Company's deprecable assets at the end of fiscal year

tableNumerator $ millionsDenominator $ millionsResult,,Percentage depreciated of depreciable assets $$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock