Question: Required a. Distinguish the difference between the pooling and separate investment account method of profit distribution. b. Given the above, which method of profit distribution

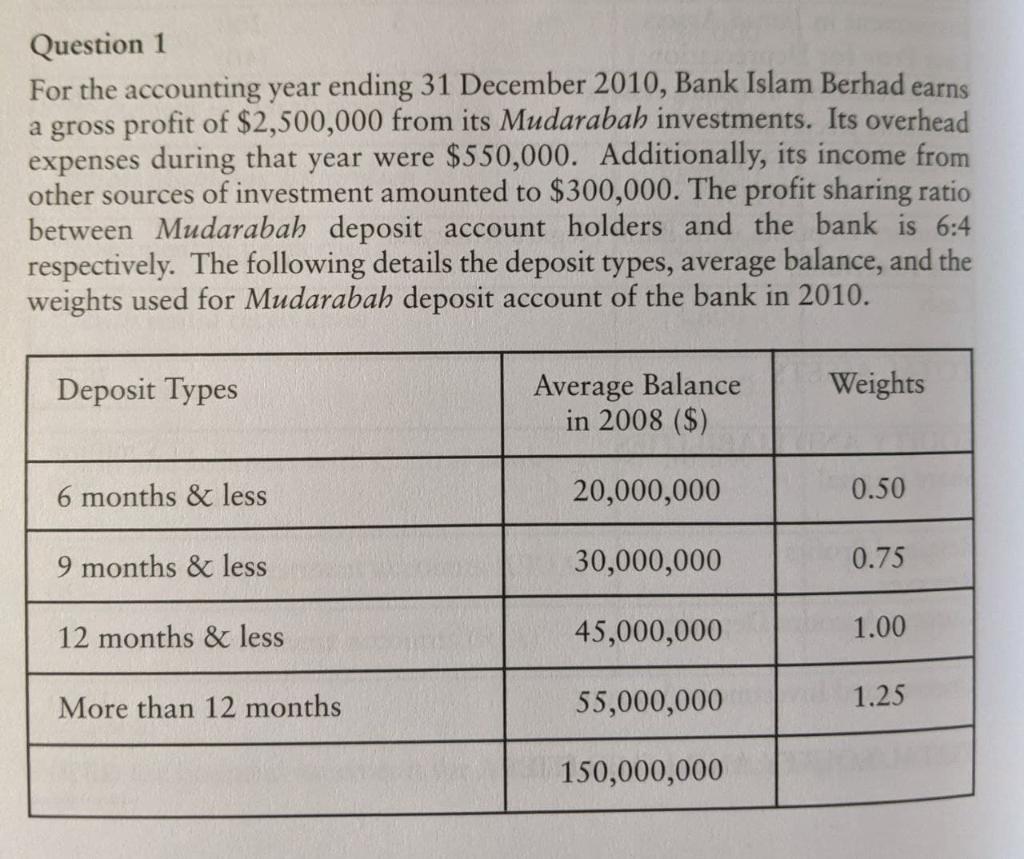

Required a. Distinguish the difference between the "pooling" and "separate investment account method" of profit distribution. b. Given the above, which method of profit distribution policy would Bank Islam adopt? c. Using your answer to (b) above, calculate the i. weighted average balance for each deposit type; ii. depositors share of profit based on the weighted average balance; and, iii. depositors rate of return for each deposit type iv. Ahmad is an investor who has invested $450,000 from 1 March 2010 to 15 September 2010. Calculate the profit due to him. Question 1 For the accounting year ending 31 December 2010, Bank Islam Berhad earns a gross profit of $2,500,000 from its Mudarabah investments. Its overhead expenses during that year were $550,000. Additionally, its income from other sources of investment amounted to $300,000. The profit sharing ratio between Mudarabah deposit account holders and the bank is 6:4 respectively. The following details the deposit types, average balance, and the weights used for Mudarabah deposit account of the bank in 2010. Deposit Types Weights Average Balance in 2008 ($) 6 months & less 20,000,000 0.50 9 months & less 30,000,000 0.75 12 months & less 45,000,000 1.00 More than 12 months 55,000,000 1.25 150,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts