Question: Required: a . Prepare a worksheet to consolidate the separate 2 0 2 4 financial statements for Abbey and Bellstar. b . How would the

Required:

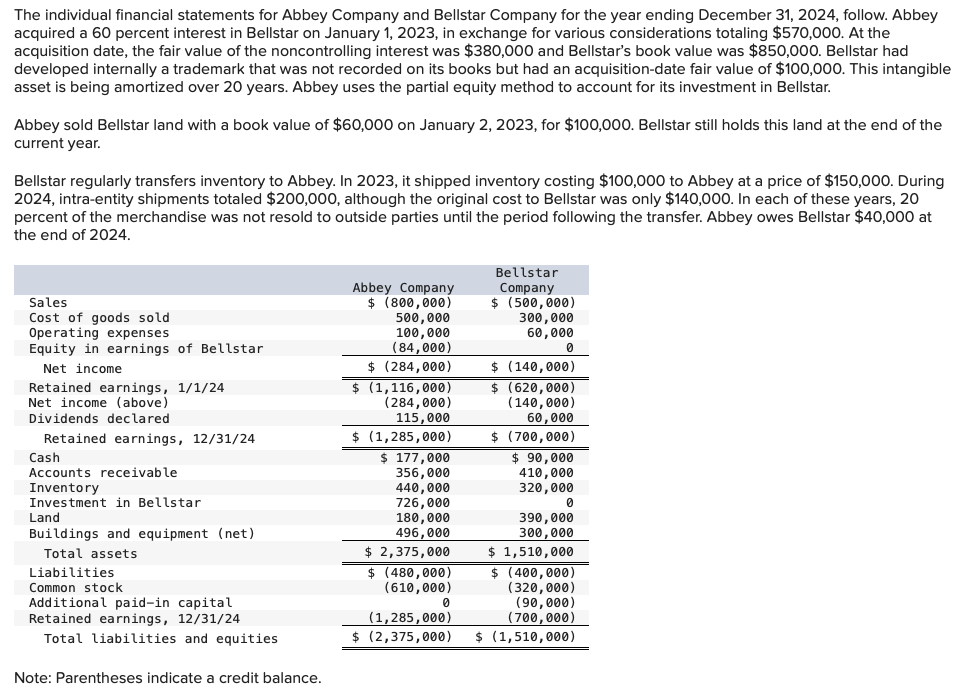

a Prepare a worksheet to consolidate the separate financial statements for Abbey and Bellstar.

b How would the consolidation entries in requirement a have differed if Abbey had sold a building on January with a $ book value cost of $ to Bellstar for $ instead of land, as the problem reports? Assume that the building had a year remaining life at the date of transfer.

How would the consolidation entries in requirement a have differed if Abbey had sold a building on January with a $ book value cost of $ to Bellstar for $ instead of land, as the problem reports? Assume that the building had a year remaining life at the date of transfer.

Note: Do not round intermediate calculations. If no entry is required for a transactionevent select No journal entry required" in the first account field.

Consolidation

Worksheet Entries

Prepare Entry TA to defer the intraentity gain as of the beginning of the year.

Note: Enter debits before credits. How would the consolidation entries in requirement a have differed if Abbey had sold a building on January with a $ book value cost of $ to Bellstar for $ instead of land, as the problem reports? Assume that the building had a year remaining life at the date of transfer.

Note: Do not round intermediate calculations. If no entry is required for a transactionevent select No journal entry required" in the first account field.

Consolidation Worksheet Entries

Prepare Entry ED to remove the excess depreciation for the current year created by the transfer price.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock