Question: Required a. Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2021. b. How much is the

Required

a. Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2021.

b. How much is the pension-related amounts that would be reported in

(i) PT OKA'S statement of

comprehensive income for the year ended December 31, 2021 and

(ii) statement of financial position as of December 31, 2021?

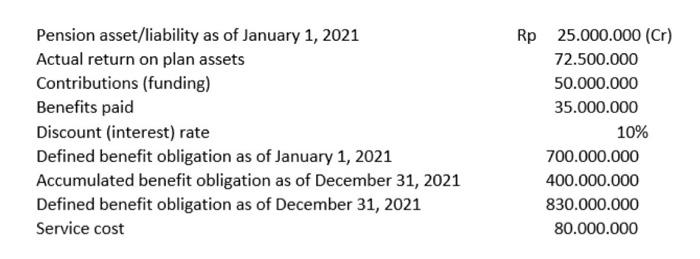

Pension asset/liability as of January 1, 2021 Actual return on plan assets Contributions (funding) Benefits paid Discount (interest) rate Defined benefit obligation as of January 1, 2021 Accumulated benefit obligation as of December 31, 2021 Defined benefit obligation as of December 31, 2021 Service cost Rp 25.000.000 (Cr) 72.500.000 50.000.000 35.000.000 10% 700.000.000 400.000.000 830.000.000 80.000.000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock