Question: Required: a . Using straight - line depreciation, calculate the depreciation expense to be recognized in the first year of the machine's life and calculate

Required:

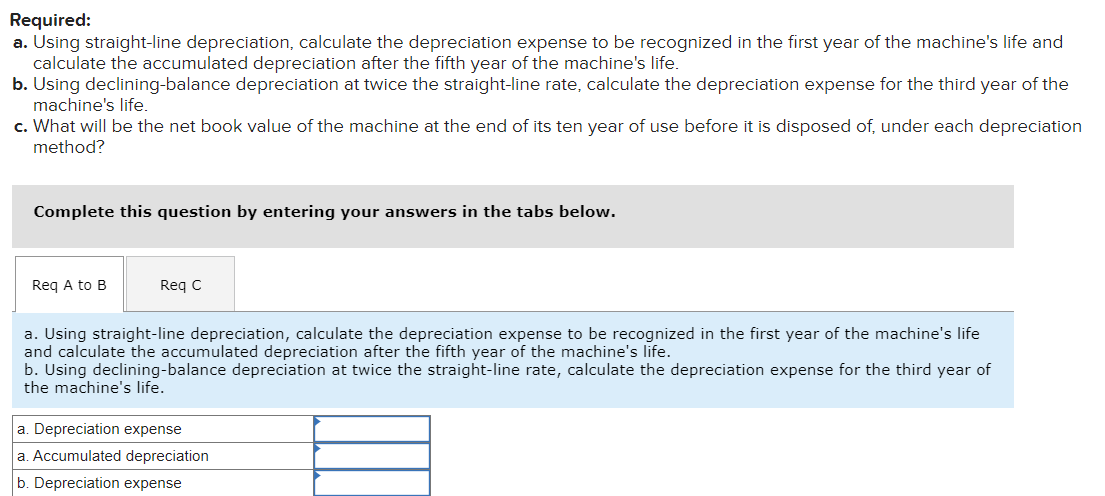

a Using straightline depreciation, calculate the depreciation expense to be recognized in the first year of the machine's life and

calculate the accumulated depreciation after the fifth year of the machine's life.

b Using decliningbalance depreciation at twice the straightline rate, calculate the depreciation expense for the third year of the

machine's life.

c What will be the net book value of the machine at the end of its ten year of use before it is disposed of under each depreciation

method?

Complete this question by entering your answers in the tabs below.

Req A to B

a Using straightline depreciation, calculate the depreciation expense to be recognized in the first year of the machine's life

and calculate the accumulated depreciation after the fifth year of the machine's life.

b Using decliningbalance depreciation at twice the straightline rate, calculate the depreciation expense for the third year of

the machine's life.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock