Question: Required: (a) What is the project's year 0 total cash flow? (b) What is the project's estimated year 1 total cash flow? (c) What is

Required:

(a) What is the project's year 0 total cash flow?

(b) What is the project's estimated year 1 total cash flow?

(c) What is the project's estimated year 2 total cash flow?

(d) What is the project's estimated year 3 total cash flow?

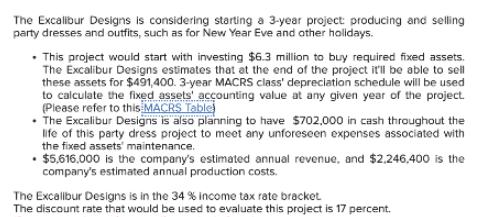

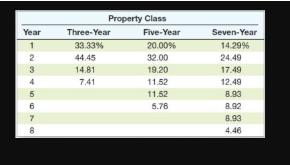

The Excalibur Designs is considering starting a 3-year project producing and selling party dresses and outfits, such as for New Year Eve and other holidays. This project would start with investing $6.3 million to buy required fixed assets. The Excalibur Designs estimates that at the end of the project it'll be able to sell these assets for $491,400. 3-year MACRS class' depreciation schedule will be used to calculate the fixed assets' accounting value at any given year of the project. (Please refer to this MACRS Table The Excalibur Designs is also planning to have $702,000 in cash throughout the life of this party dress project to meet any unforeseen expenses associated with the fixed assets maintenance. $5,616,000 is the company's estimated annual revenue, and $2,246,400 is the company's estimated annual production costs. The Excalibur Designs is in the 34 % income tax rate bracket. The discount rate that would be used to evaluate this project is 17 percent.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

a Year 0 Total Cash Flow Cash Inflow 6300000 Cash Out... View full answer

Get step-by-step solutions from verified subject matter experts