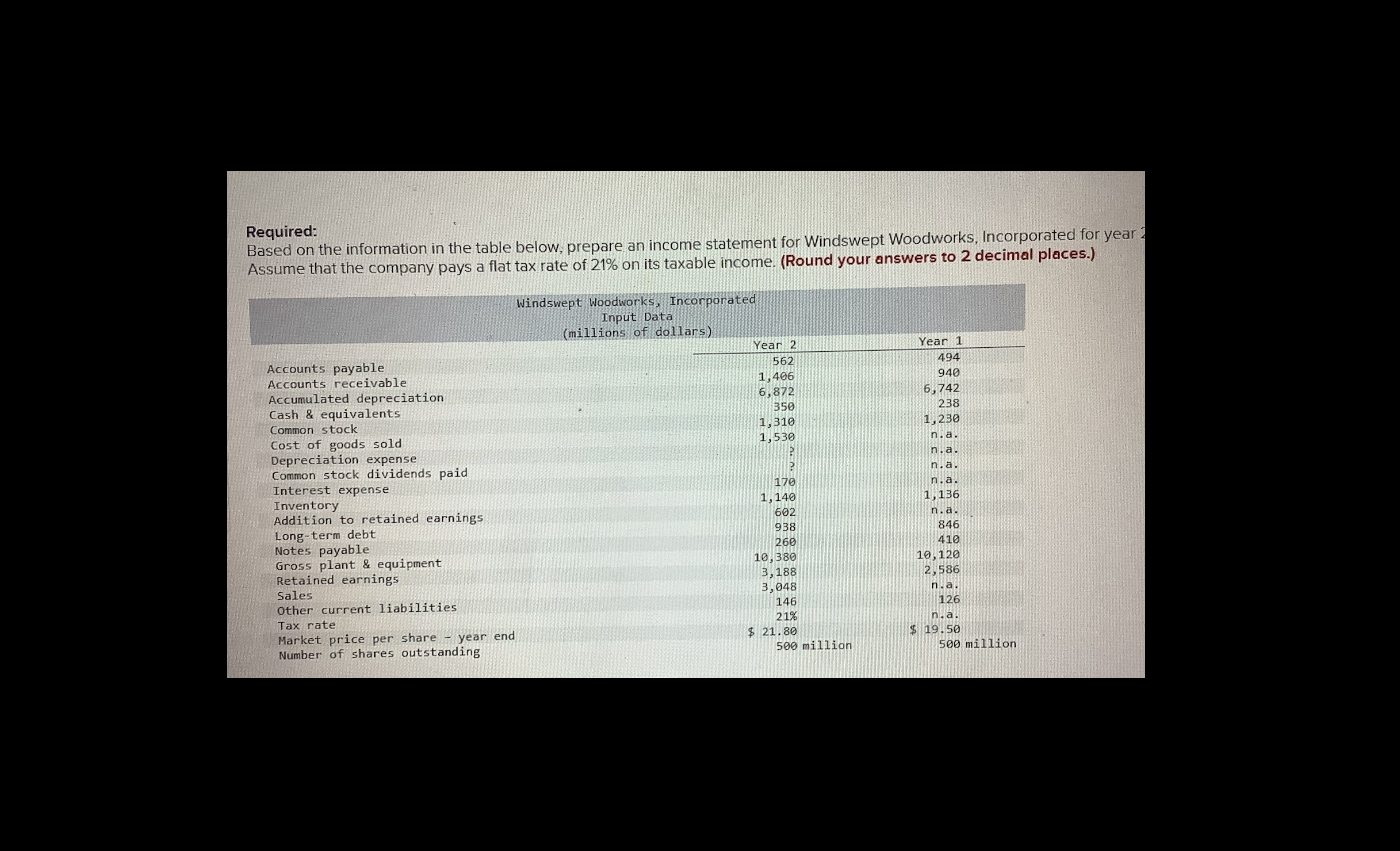

Question: Required: Based on the information in the table below, prepare an income statement for Windswept Woodworks, Incorporated for year Assume that the company pays a

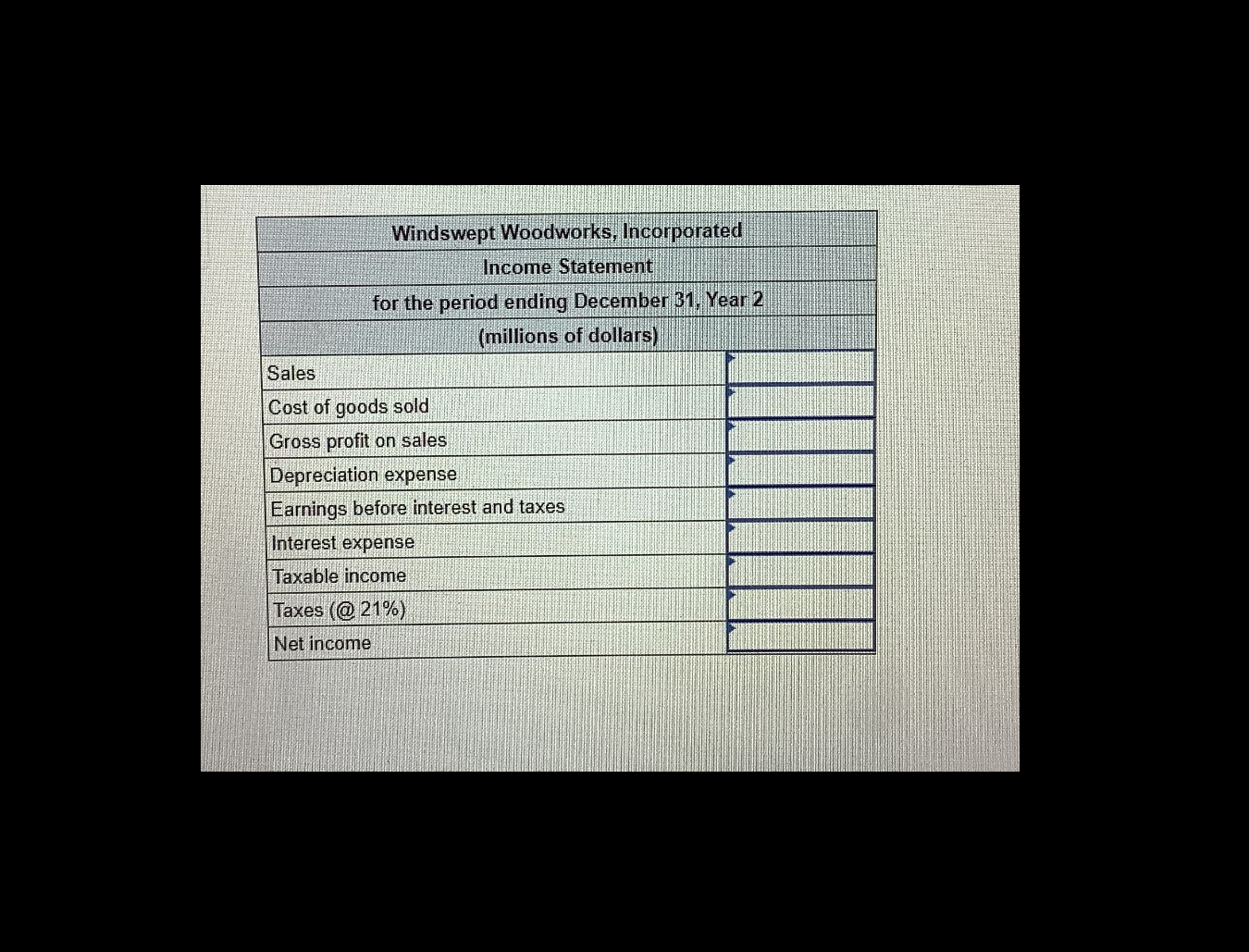

Required: Based on the information in the table below, prepare an income statement for Windswept Woodworks, Incorporated for year Assume that the company pays a flat tax rate of 21% on its taxable income. (Round your answers to 2 decimal places.) \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Windswept Woodworks, Incorporated } \\ Income Statement \\ \hline (millions of dollars) \\ \hline Sales \\ \hline Cost of goods sold \\ \hline Gross profit on sales \\ \hline Depreciation expense \\ \hline Earnings before interest and taxes \\ \hline Interest expense \\ \hline Taxable income \\ \hline Taxes (@ 21\%) \\ \hline Net income \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts