Question: Required: Consider the disclosure note on long-term debt, and answer the following questions relating to 2019. a) What is the average contractual interest rate of

Required:

Consider the disclosure note on long-term debt, and answer the following questions relating to 2019.

a) What is the average contractual interest rate of senior notes?

b) What is the range of time in month and years that the notes will mature? What the total amount of outstanding long-term debts- separated between current and non-current portions?

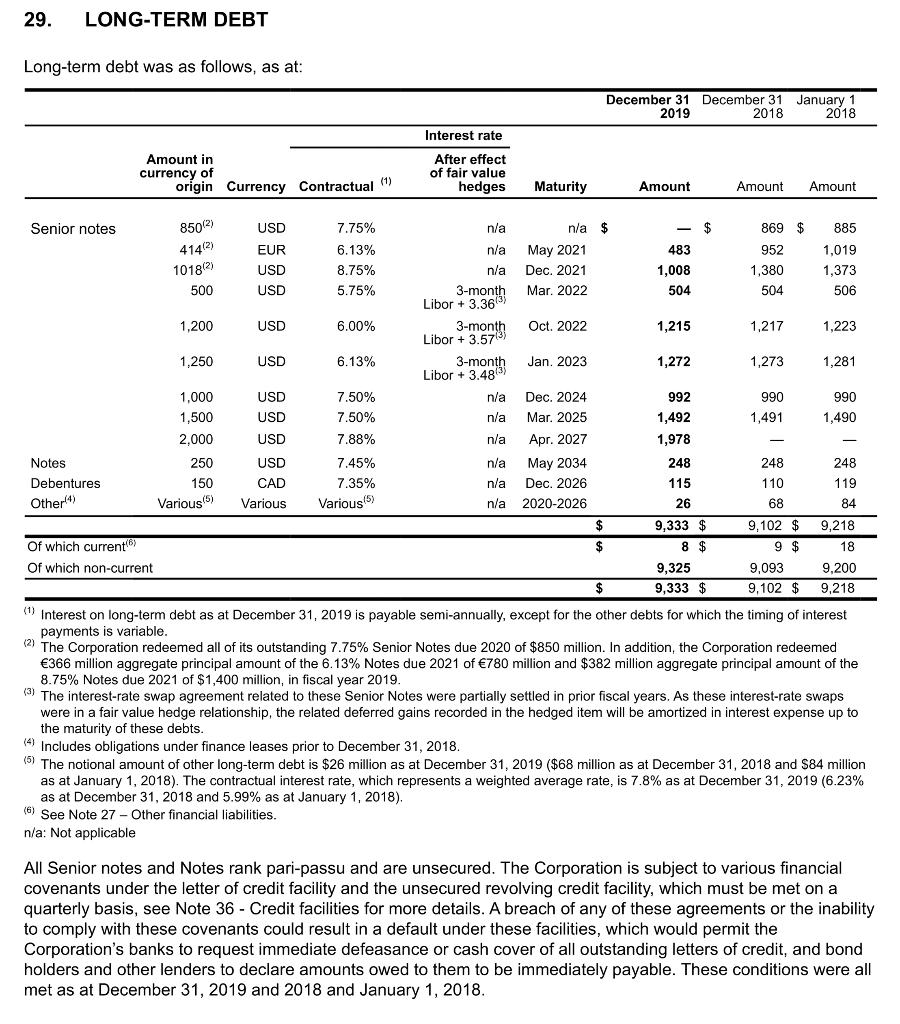

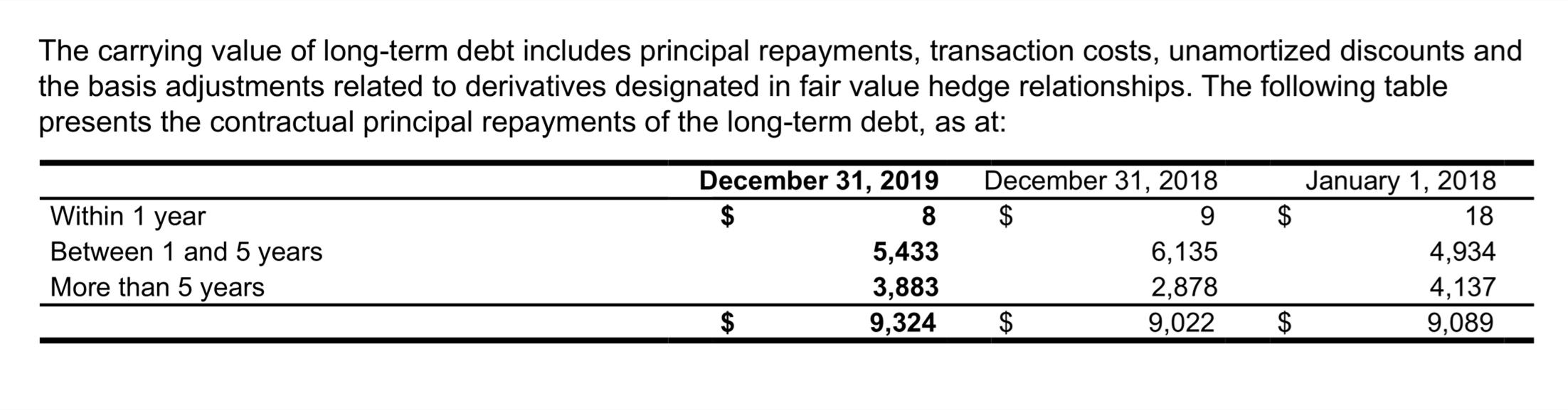

29. LONG-TERM DEBT Long-term debt was as follows, as at: December 31 December 31 January 1 2019 2018 2018 Amount in currency of origin Currency Contractual (1) Interest rate After effect of fair value hedges Maturity Amount Amount Amount Other) Senior notes 850(2) USD 7.75% n/a n/a $ - $ 869 $ 885 41462) EUR 6.13% n/a May 2021 483 952 1,019 101812) USD 8.75% n/a Dec. 2021 1,008 1,380 1,373 500 USD 5.75% 3-month Mar. 2022 504 504 506 Libor + 3.36 1,200 USD 6.00% 3-month Oct. 2022 1,215 1.217 1.223 Libor + 3.57(3) 1,250 USD 6.13% 3-month Jan. 2023 1,272 1,273 1,281 Libor + 3.48% 1,000 USD 7.50% n/a Dec. 2024 992 990 990 1,500 USD 7.50% n/a Mar. 2025 1,492 1,491 1,490 2,000 USD 7.88% n/a Apr. 2027 1,978 Notes 250 USD 7.45% n/a May 2034 248 248 248 Debentures 150 CAD 7.35% n/a Dec. 2026 115 110 119 Various Various Various(5) n/a 2020-2026 26 68 84 $ 9,333 $ 9,102 $ 9,218 Of which current) $ 8 $ 9 $ 18 Of which non-current 9,325 9,093 9.200 $ 9,333 $ 9,102 $ 9,218 (1) Interest on long-term debt as at December 31, 2019 is payable semi-annually, except for the other debts for which the timing of interest payments is variable. (2) The Corporation redeemed all of its outstanding 7.75% Senior Notes due 2020 of $850 million. In addition, the Corporation redeemed 366 million aggregate principal amount of the 6.13% Notes due 2021 of 780 million and $382 million aggregate principal amount of the 8.75% Notes due 2021 of $1,400 million, in fiscal year 2019 (3) The interest-rate swap agreement related to these Senior Notes were partially settled in prior fiscal years. As these interest-rate swaps were in a fair value hedge relationship, the related deferred gains recorded in the hedged item will be amortized in interest expense up to the maturity of these debts. 14 Includes obligations under finance leases prior to December 31, 2018. (5) The notional amount of other long-term debt is $26 million as at December 31, 2019 ($68 million as at December 31, 2018 and $84 million as at January 1, 2018). The contractual interest rate, which represents a weighted average rate, is 7.8% as at December 31, 2019 (6.23% as at December 31, 2018 and 5.99% as at January 1, 2018). (6) See Note 27 - Other financial liabilities. n/a: Not applicable All Senior notes and Notes rank pari-passu and are unsecured. The Corporation is subject to various financial covenants under the letter of credit facility and the unsecured revolving credit facility, which must be met on a quarterly basis, see Note 36 - Credit facilities for more details. A breach of any of these agreements or the inability to comply with these covenants could result in a default under these facilities, which would permit the Corporation's banks to request immediate defeasance or cash cover of all outstanding letters of credit, and bond holders and other lenders to declare amounts owed to them to be immediately payable. These conditions were all met as at December 31, 2019 and 2018 and January 1, 2018. The carrying value of long-term debt includes principal repayments, transaction costs, unamortized discounts and the basis adjustments related to derivatives designated in fair value hedge relationships. The following table presents the contractual principal repayments of the long-term debt, as at: 3 Within 1 year Between 1 and 5 years More than 5 years December 31, 2019 8 5,433 3,883 $ 9,324 December 31, 2018 $ 9 6,135 2,878 $ 9,022 January 1, 2018 $ 18 4,934 4,137 $ 9,089

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts