Question: Required ( i ) If you accept these quotes, how many EUR, S F r , and GBP do you have at departure? ( ii

Required

i If you accept these quotes, how many EUR, and GBP do you have at

departure?

ii If you return with EUR AND GBP and the exchange rates are

unchanged, how many KES do you have?

iii Suppose that instead of selling your remaining EUR once you return home,

you want to sell them in Great Britain. At the train station, you are offered

GBPEUR while a bank three blocks from the station offers GBPEUR

At what rate are you willing to sell your EUR How many GBP

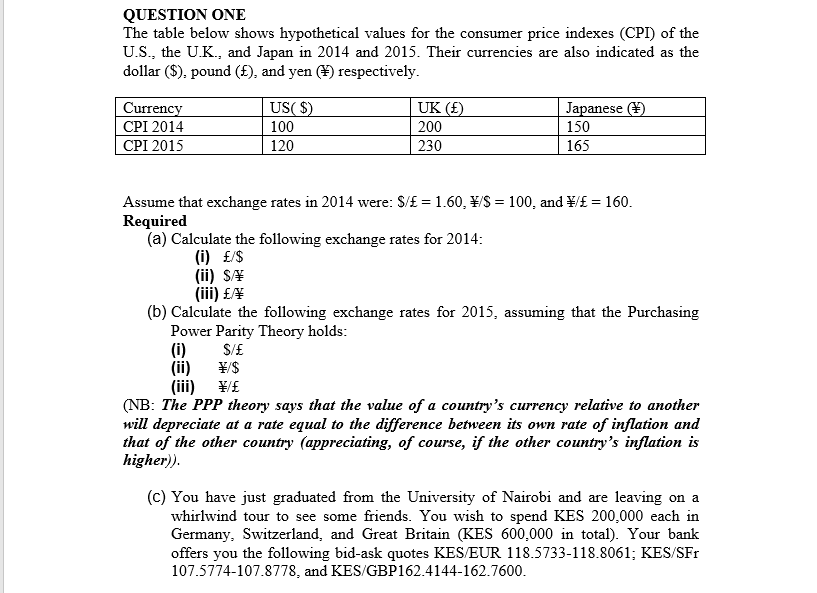

will you receive?QUESTION ONE

The table below shows hypothetical values for the consumer price indexes CPI of the

US the UK and Japan in and Their currencies are also indicated as the

dollar $ pound and yen respectively.

Assume that exchange rates in were: and

Required

a Calculate the following exchange rates for :

i

ii

iii

b Calculate the following exchange rates for assuming that the Purchasing

Power Parity Theory holds:

i

ii

iii

NB: The PPP theory says that the value of a country's currency relative to another

will depreciate at a rate equal to the difference between its own rate of inflation and

that of the other country appreciating of course, if the other country's inflation is

higher

c You have just graduated from the University of Nairobi and are leaving on a

whirlwind tour to see some friends. You wish to spend KES each in

Germany, Switzerland, and Great Britain KES in total Your bank

offers you the following bidask quotes KESEUR ; KESSFr

and KESGBP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock