Question: Required information C7-1 (Algo) Computing and Evaluating Financial Statement Effects of Alternative Inventory Costing Methods (Chapters 2 and 7) [LO 2-5, LO 7-3] [The following

![Alternative Inventory Costing Methods (Chapters 2 and 7) [LO 2-5, LO 7-3]](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66c1bbc764581_55166c1bbc7065aa.jpg)

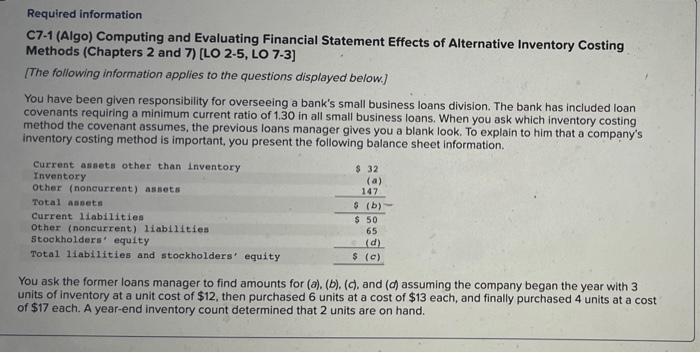

Required information C7-1 (Algo) Computing and Evaluating Financial Statement Effects of Alternative Inventory Costing Methods (Chapters 2 and 7) [LO 2-5, LO 7-3] [The following information applies to the questions displayed below.] You have been given responsibility for overseeing a bank's small business loans division. The bank has included loan covenants requiring a minimum current ratio of 1.30 in all small business loans. When you ask which inventory costing method the covenant assumes, the previous loans manager gives you a blank look. To explain to him that a company's inventory costing method is important, you present the following balance sheet information. You ask the former loans manager to find amounts for (a), (b), (c), and ( d ) assuming the company began the year with 3 units of inventory at a unit cost of $12, then purchased 6 units at a cost of $13 each, and finally purchased 4 units at a cost of $17 each. A year-end inventory count determined that 2 units are on hand. 1. Determine the amount for (a) using FIFO, and then calculate (b) through (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts