Question: Required information Comprehenslve Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10.4, LO 10-5) (StetIC) [The following information applies to the questions displayed below.]

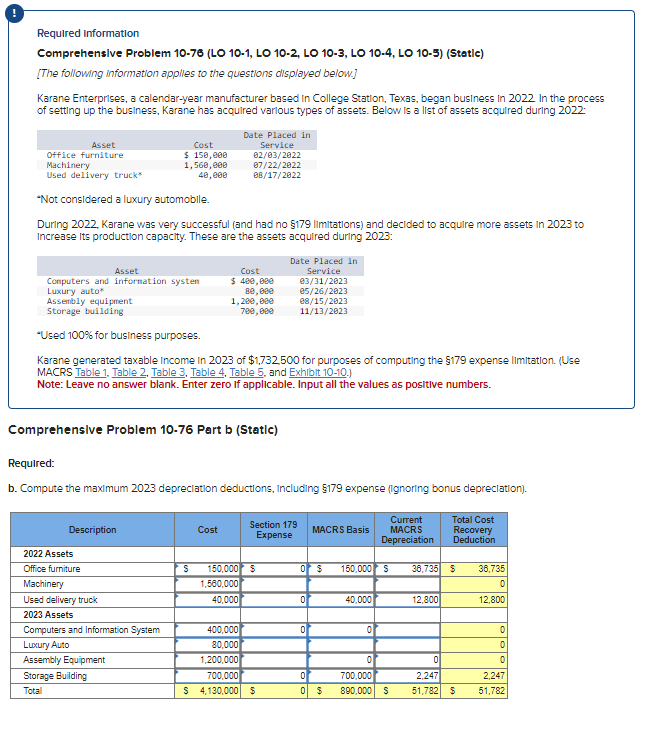

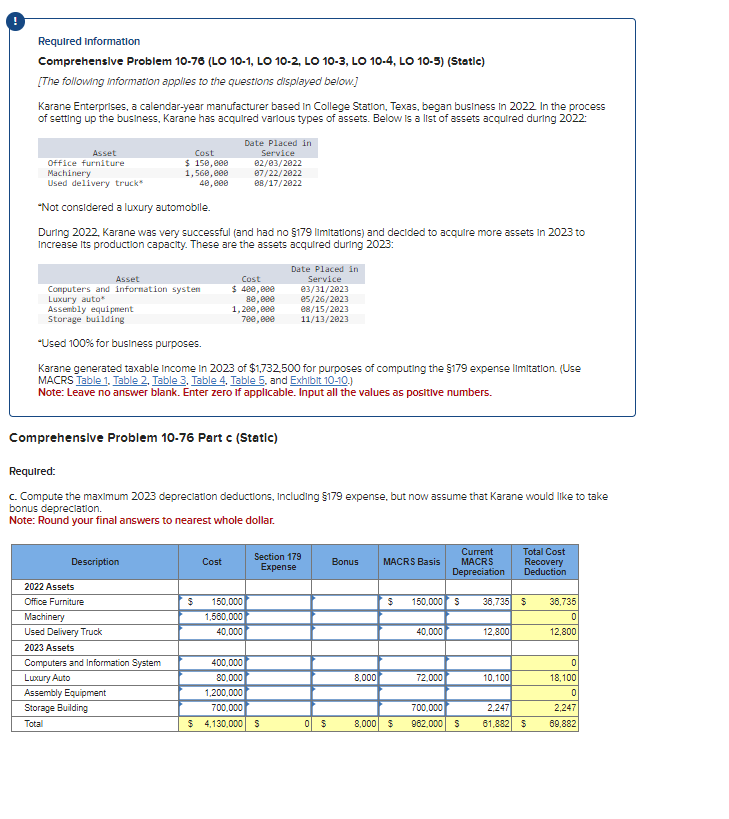

Required information Comprehenslve Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10.4, LO 10-5) (StetIC) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began busIness In 2022 In the process of settling up the business, Karane has acquired varlous types of assets. Below is a list of assets acquired durling 2022 : "Not considered a luxury automoblle. Durling 2022, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2023 to increase Its production capacity. These are the assets acquired during 2023 : -Used 100% for business purposes. Karane generated taxable Income in 2023 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2. Table 3, Table 4. Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Comprehensive Problem 10.76 Part b (Statlc) Required: b. Compute the maximum 2023 depreclation deductions, Including $179 expense (Ignoring bonus depreclation). Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10.4, LO 10-5) (Stetic) [The following information applies to the questions alisplayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began business in 2022 In the process of settling up the business, Karane has acquired varlous types of assets. Below ls a list of assets acquired durling 2022 . "Not considered a luxury automoblle. Durling 2022, Karane was very successful (and had no \$179 limitations) and decided to acquire more assets in 2023 to Increase Its production capacity. These are the assets acquired during 2023 : -Used 100% for business purposes. Karane generated taxable Income In 2023 of \$1,732,500 for purposes of computing the \$179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4. Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Comprehensive Problem 10.76 Part c (Static) Required: c. Compute the maximum 2023 depreclatlon deductions, Including \$179 expense, but now assume that Karane would like to take bonus depreclation. Note: Round your final answers to nearest whole dollar. Required information Comprehenslve Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10.4, LO 10-5) (StetIC) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began busIness In 2022 In the process of settling up the business, Karane has acquired varlous types of assets. Below is a list of assets acquired durling 2022 : "Not considered a luxury automoblle. Durling 2022, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2023 to increase Its production capacity. These are the assets acquired during 2023 : -Used 100% for business purposes. Karane generated taxable Income in 2023 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2. Table 3, Table 4. Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Comprehensive Problem 10.76 Part b (Statlc) Required: b. Compute the maximum 2023 depreclation deductions, Including $179 expense (Ignoring bonus depreclation). Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10.4, LO 10-5) (Stetic) [The following information applies to the questions alisplayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began business in 2022 In the process of settling up the business, Karane has acquired varlous types of assets. Below ls a list of assets acquired durling 2022 . "Not considered a luxury automoblle. Durling 2022, Karane was very successful (and had no \$179 limitations) and decided to acquire more assets in 2023 to Increase Its production capacity. These are the assets acquired during 2023 : -Used 100% for business purposes. Karane generated taxable Income In 2023 of \$1,732,500 for purposes of computing the \$179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4. Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Comprehensive Problem 10.76 Part c (Static) Required: c. Compute the maximum 2023 depreclatlon deductions, Including \$179 expense, but now assume that Karane would like to take bonus depreclation. Note: Round your final answers to nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Comprehensive Problem 1076 Part b Static Solution To compute the maximum 2023 depreciation deductions including 179 expense but ignoring bonus depreciation the steps are as follows Asset Depreciation ... View full answer

Get step-by-step solutions from verified subject matter experts