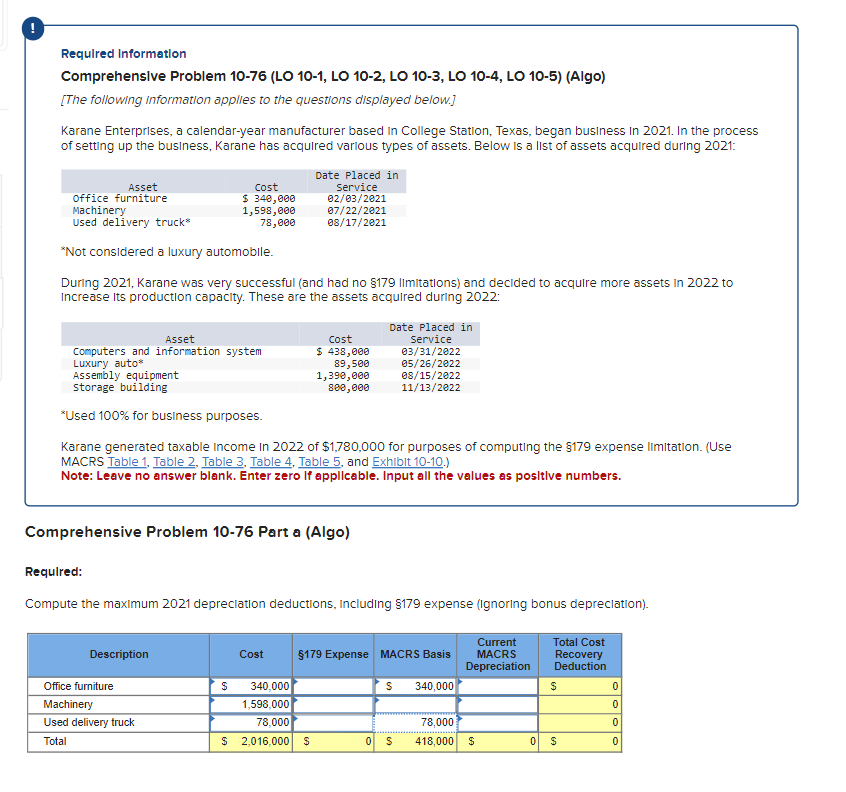

Question: Required Information Comprehenslve Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (AlgO) [The following information applies to the questions displayed below.]

![displayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eb41bed4546_82266eb41be6c5ea.jpg)

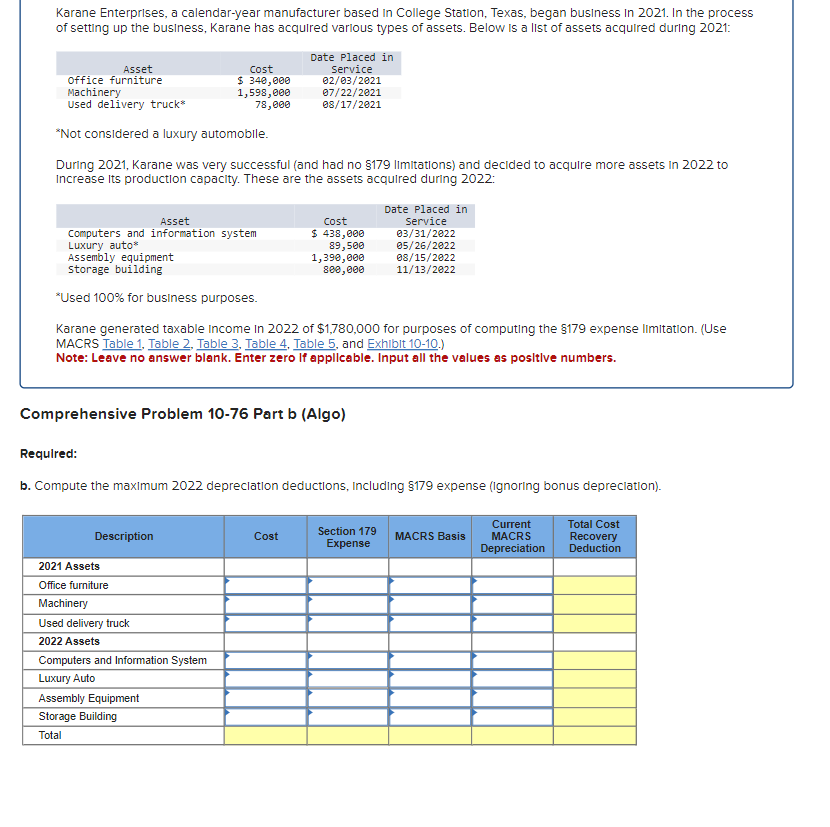

Required Information Comprehenslve Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (AlgO) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began business In 2021. In the proces of settlng up the business, Karane has acquired varlous types of assets. Below Is a list of assets acquired during 2021 : Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 Ilmitations) and decided to acquire more assets in 2022 to Increase its production capacity. These are the assets acqulred during 2022 : *Used 100% for business purposes. Karane generated taxable Income In 2022 of $1,780,000 for purposes of computing the $179 expense IImltation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero lf appllcable. Input all the values as posltive numbers. Comprehensive Problem 10-76 Part a (Algo) Required: Compute the maximum 2021 depreclation deductions, Including $179 expense (Ignoring bonus depreciation). Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business In 2021. In the process of setting up the business, Karane has acquired varlous types of assets. Below Is a list of assets acquired during 2021 : *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to Increase Its production capacity. These are the assets acqulred during 2022 : *Used 100% for business purposes. Karane generated taxable Income in 2022 of $1,780,000 for purposes of computing the $179 expense lImltation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero lf applicable. Input all the values as positive numbers. Comprehensive Problem 10-76 Part b (Algo) Required: b. Compute the maximum 2022 depreclation deductions, Including $179 expense (Ignoring bonus depreclation). Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began business In 2021. In the process of setting up the business, Karane has acquired varlous types of assets. Below Is a list of assets acquired during 2021 : *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to Increase its production capacity. These are the assets acqulred during 2022 : *Used 100% for business purposes. Karane generated taxable Income In 2022 of $1,780,000 for purposes of computing the $179 expense IImltation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Note: Leave no answer blank. Enter zero lf appllcable. Input all the values as posltive numbers. Comprehensive Problem 10-76 Part c (Algo) Required: c. Compute the maximum 2022 depreclation deductions, Including $179 expense, but now assume that Karane would like to take bonus depreclation. Required Information Comprehenslve Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (AlgO) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began business In 2021. In the proces of settlng up the business, Karane has acquired varlous types of assets. Below Is a list of assets acquired during 2021 : Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 Ilmitations) and decided to acquire more assets in 2022 to Increase its production capacity. These are the assets acqulred during 2022 : *Used 100% for business purposes. Karane generated taxable Income In 2022 of $1,780,000 for purposes of computing the $179 expense IImltation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero lf appllcable. Input all the values as posltive numbers. Comprehensive Problem 10-76 Part a (Algo) Required: Compute the maximum 2021 depreclation deductions, Including $179 expense (Ignoring bonus depreciation). Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business In 2021. In the process of setting up the business, Karane has acquired varlous types of assets. Below Is a list of assets acquired during 2021 : *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to Increase Its production capacity. These are the assets acqulred during 2022 : *Used 100% for business purposes. Karane generated taxable Income in 2022 of $1,780,000 for purposes of computing the $179 expense lImltation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhlbit 10-10.) Note: Leave no answer blank. Enter zero lf applicable. Input all the values as positive numbers. Comprehensive Problem 10-76 Part b (Algo) Required: b. Compute the maximum 2022 depreclation deductions, Including $179 expense (Ignoring bonus depreclation). Karane Enterprises, a calendar-year manufacturer based In College Station, Texas, began business In 2021. In the process of setting up the business, Karane has acquired varlous types of assets. Below Is a list of assets acquired during 2021 : *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to Increase its production capacity. These are the assets acqulred during 2022 : *Used 100% for business purposes. Karane generated taxable Income In 2022 of $1,780,000 for purposes of computing the $179 expense IImltation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Note: Leave no answer blank. Enter zero lf appllcable. Input all the values as posltive numbers. Comprehensive Problem 10-76 Part c (Algo) Required: c. Compute the maximum 2022 depreclation deductions, Including $179 expense, but now assume that Karane would like to take bonus depreclation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts