Answered step by step

Verified Expert Solution

Question

1 Approved Answer

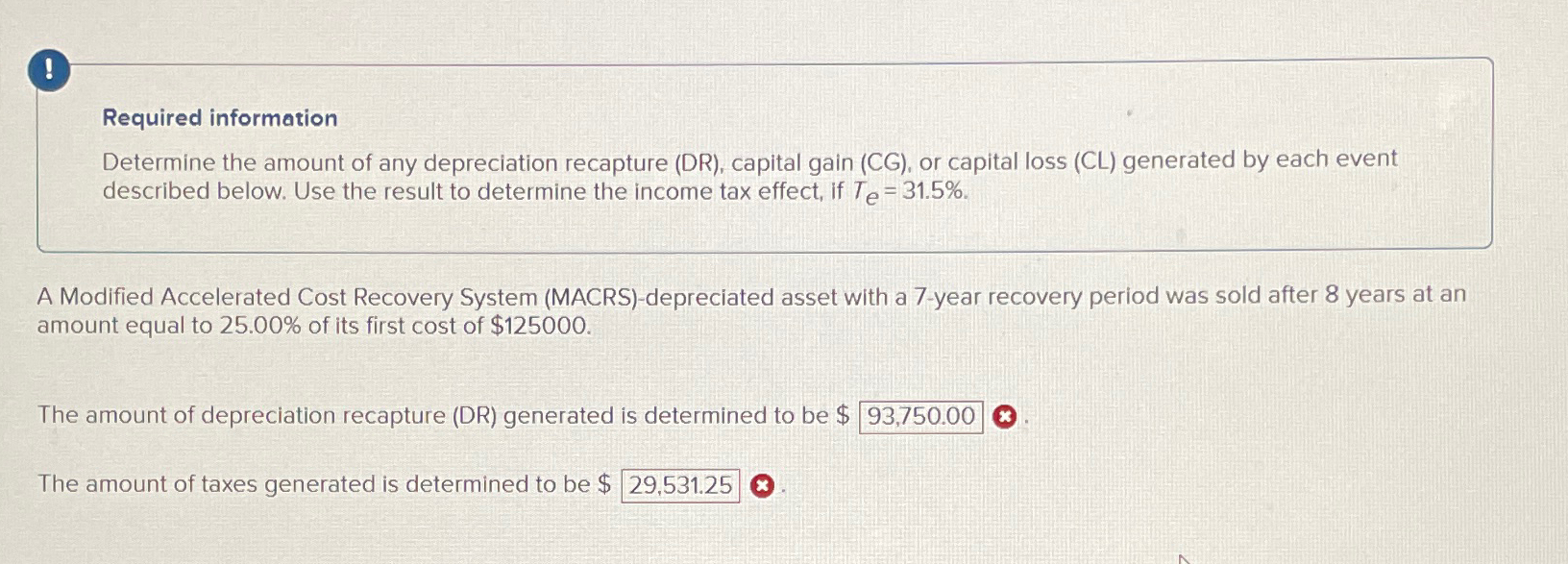

! Required information Determine the amount of any depreciation recapture (DR), capital gain (CG), or capital loss (CL) generated by each event described below.

! Required information Determine the amount of any depreciation recapture (DR), capital gain (CG), or capital loss (CL) generated by each event described below. Use the result to determine the income tax effect, if Te = 31.5%. A Modified Accelerated Cost Recovery System (MACRS)-depreciated asset with a 7-year recovery period was sold after 8 years at an amount equal to 25.00% of its first cost of $125000. The amount of depreciation recapture (DR) generated is determined to be $ 93,750.00 The amount of taxes generated is determined to be $ 29,531.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started