Question: Required information E8-3 (Algo) Computing and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) LO8- 2, 8-3 [The following information applies to the questions displayed

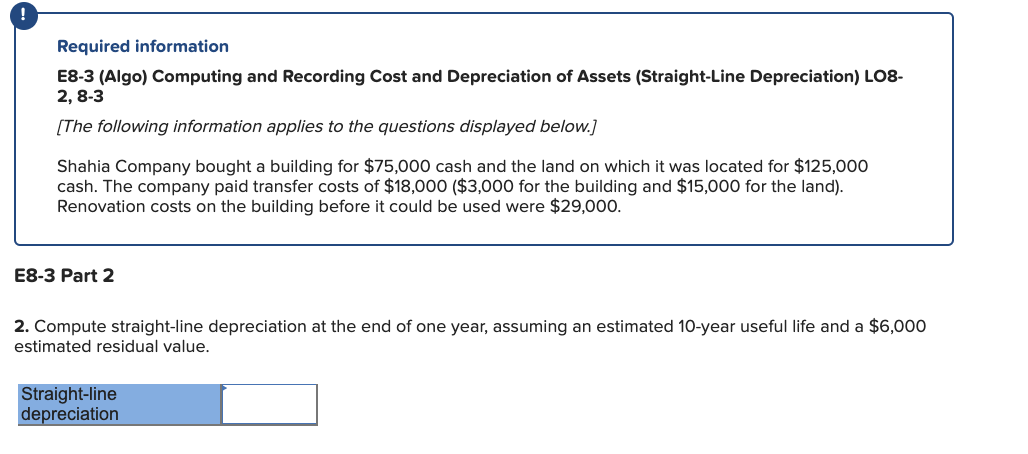

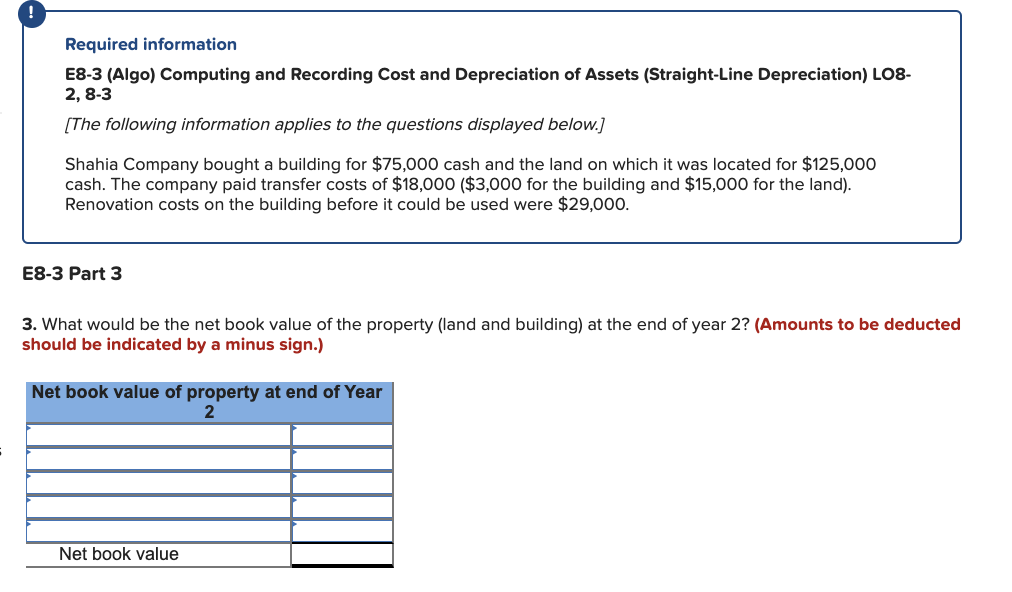

Required information E8-3 (Algo) Computing and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) LO8- 2, 8-3 [The following information applies to the questions displayed below. Shahia Company bought a building for $75,000 cash and the land on which it was located for $125,000 cash. The company paid transfer costs of $18,000 ($3,000 for the building and $15,000 for the land). Renovation costs on the building before it could be used were $29,000. E8-3 Part 2 2. Compute straight-line depreciation at the end of one year, assuming an estimated 10-year useful life and a $6,000 estimated residual value. Straight-line depreciation Required information E8-3 (Algo) Computing and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) LO8- 2, 8-3 [The following information applies to the questions displayed below.) Shahia Company bought a building for $75,000 cash and the land on which it was located for $125,000 cash. The company paid transfer costs of $18,000 ($3,000 for the building and $15,000 for the land). Renovation costs on the building before it could be used were $29,000. E8-3 Part 3 3. What would be the net book value of the property (and and building) at the end of year 2? (Amounts to be deducted should be indicated by a minus sign.) Net book value of property at end of Year Net book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts