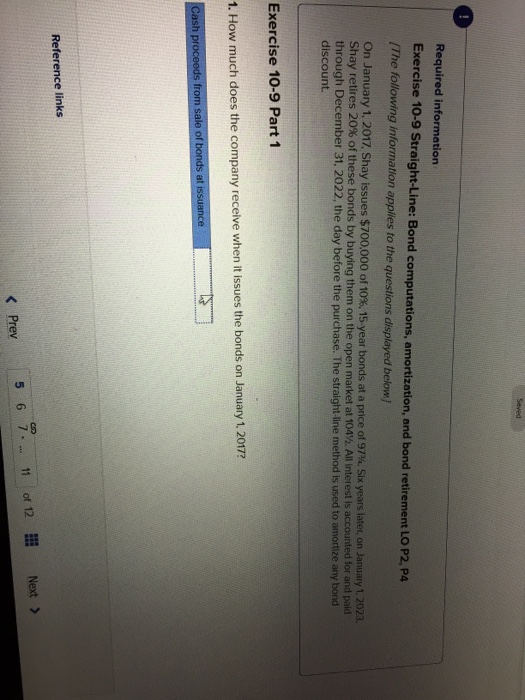

Question: Required information Exercise 10-9 Straight-Line: Bond computations, amortization, and bond retirement LO P2, P4 (The following information applies to the questions displayed below On January

Required information Exercise 10-9 Straight-Line: Bond computations, amortization, and bond retirement LO P2, P4 (The following information applies to the questions displayed below On January 1, 2017. Shay issues $700,000 of 10%, 15-year bonds at a price of 97%, six years later, on January 1, 2023 Shay retires 20% of these bonds by buying them on the open market at 104%. All interest is accounted for and paid through December 31. 2022, the day before the purchase. The straight-line method is used to amortize any bond discount. Exercise 10-9 Part 1 1. How much does the company receive when it issues the bonds on January 1. 2017 Reference links Next > 5 6 7 11 of 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts