Question: Required information Exercise 10-9 Straight-Line: Bond computations, amortization, and bond retirement LO P2, P4 [The following information applies to the questions displayed below) On January

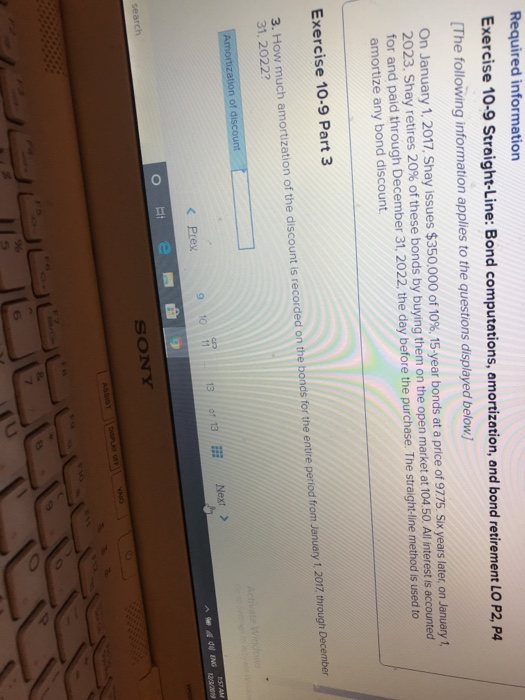

Required information Exercise 10-9 Straight-Line: Bond computations, amortization, and bond retirement LO P2, P4 [The following information applies to the questions displayed below) On January 1, 2017, Shay issues $350,000 of 10%, 15-year bonds at a price of 9775. Six years later, on January 1, 2023. Shay retires 20% of these bonds by buying them on the open market at 104.50. All interest is accounted for and paid through December 31, 2022, the day before the purchase. The straight-line method is used to amortize any bond discount Exercise 10-9 Part 3 3. How much amortization of the discount is recorded on the bonds for the entire period from January 1, 2017 through December 31, 20222 Wed Amortization of discount ASTAM of 13 Next > 11 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts