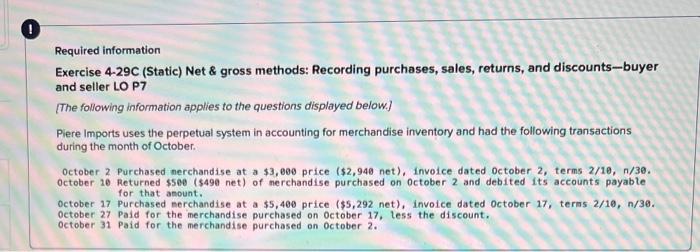

Question: Required information Exercise 4-29C (Static) Net & gross methods: Recording purchases, sales, returns, and discounts-buyer and seller LO P7 [The following information applies to the

![to the questions displayed below.] Piere Imports uses the perpetual system in](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67188448b4816_9766718844846719.jpg)

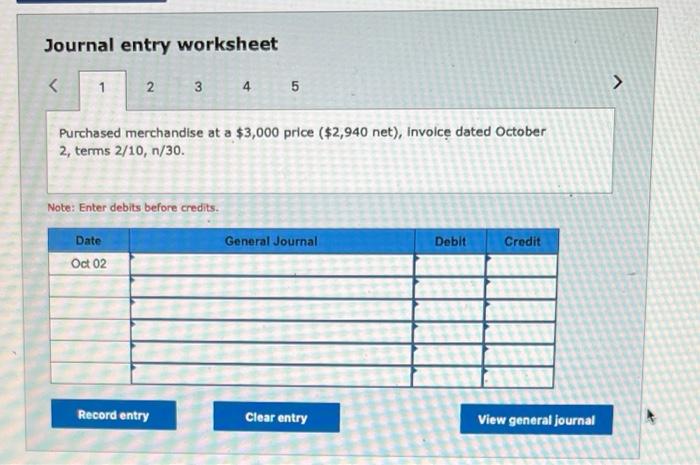

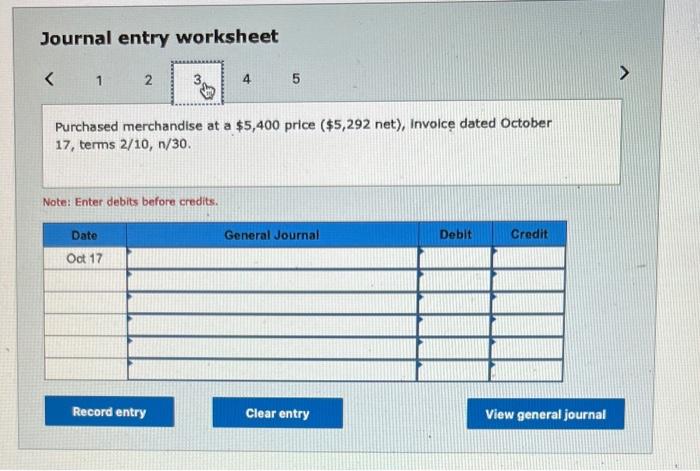

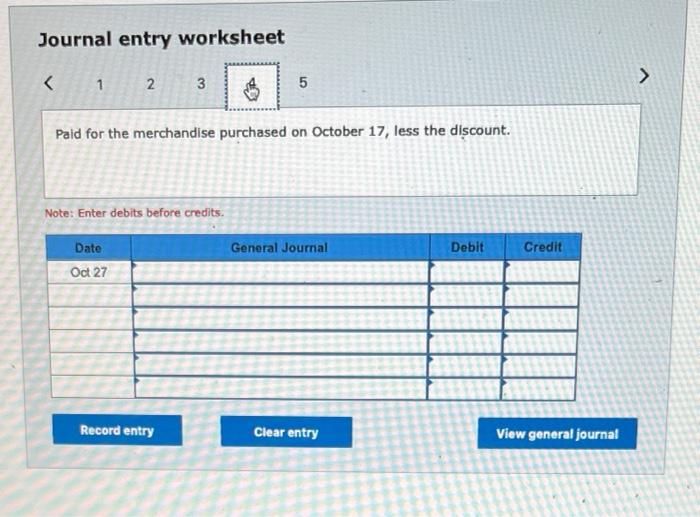

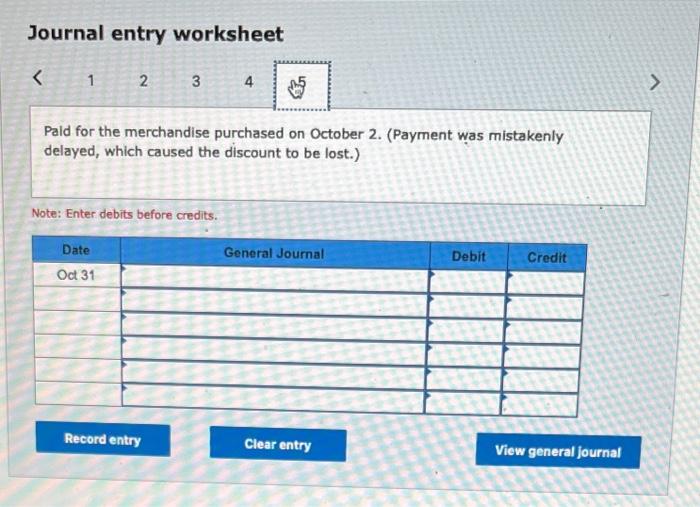

Required information Exercise 4-29C (Static) Net \& gross methods: Recording purchases, sales, returns, and discounts-buyer and seller LO P7 [The following information applies to the questions displayed below.] Piere Imports uses the perpetual system in accounting for merchandise inventory and had the following transactions during the month of October. October 2 Purchased nerchandise at a $3,600 price ($2,940 net), invoice dated october 2, terms 2/10, n/3e. october 20 Returned $50e (\$490 net) of merchandise purchased on october 2 and debited its accounts payable for that anount. october 27 Purchased nerchandise at a $5,400price($5,292 net), invoice dated october 17, terms 2/16,n/30. october 27 Paid for the merchandise purchased on october 17, less the discount. october 31 Paid for the merchandise purchased on october 2 . Journal entry worksheet Purchased merchandise at a $3,000 price ($2,940 net), invoice dated October 2,terms2/10,n/30 Note: Enter debits before credits. Journal entry worksheet Returned $500 ( $490 net) of merchandise purchased on October 2, and debited its accounts payable for that amount. Note: Enter debits before credits. Journal entry worksheet Purchased merchandise at a $5,400 price ($5,292 net), Invoice dated October 17, terms 2/10,n/30. Note: Enter debits before credits. Journal entry worksheet Paid for the merchandise purchased on October 17, less the discount. Note: Enter debits before credits. Journal entry worksheet Pald for the merchandise purchased on October 2. (Payment was mistakenly delayed, which caused the discount to be lost.) Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts