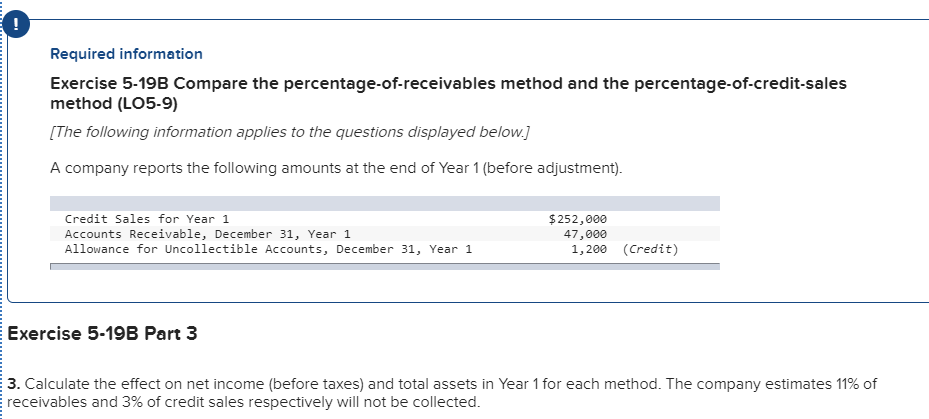

Question: Required information Exercise 5-19B Compare the percentage-of-receivables method and the percentage-of-credit-sales method (LO5-9) [The following information applies to the questions displayed below.) A company reports

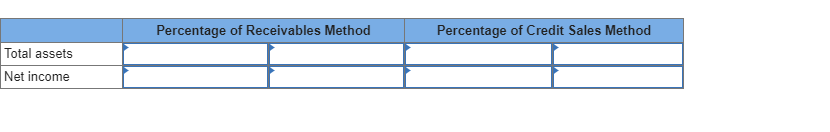

Required information Exercise 5-19B Compare the percentage-of-receivables method and the percentage-of-credit-sales method (LO5-9) [The following information applies to the questions displayed below.) A company reports the following amounts at the end of Year 1 (before adjustment). Credit Sales for Year 1 Accounts Receivable, December 31, Year 1 Allowance for Uncollectible Accounts, December 31, Year 1 $ 252,000 47,000 1,200 (Credit) Exercise 5-19B Part 3 3. Calculate the effect on net income (before taxes) and total assets in Year 1 for each method. The company estimates 11% of receivables and 3% of credit sales respectively will not be collected. Percentage of Receivables Method Percentage of Credit Sales Method Total assets Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts