Question: Required information Exercise 6-21 (Algo) Complete the accounting cycle using inventory transactions (LO62,63,65,66,6 7) On January 1, 2024, the general ledger of Big Blast Fireworks

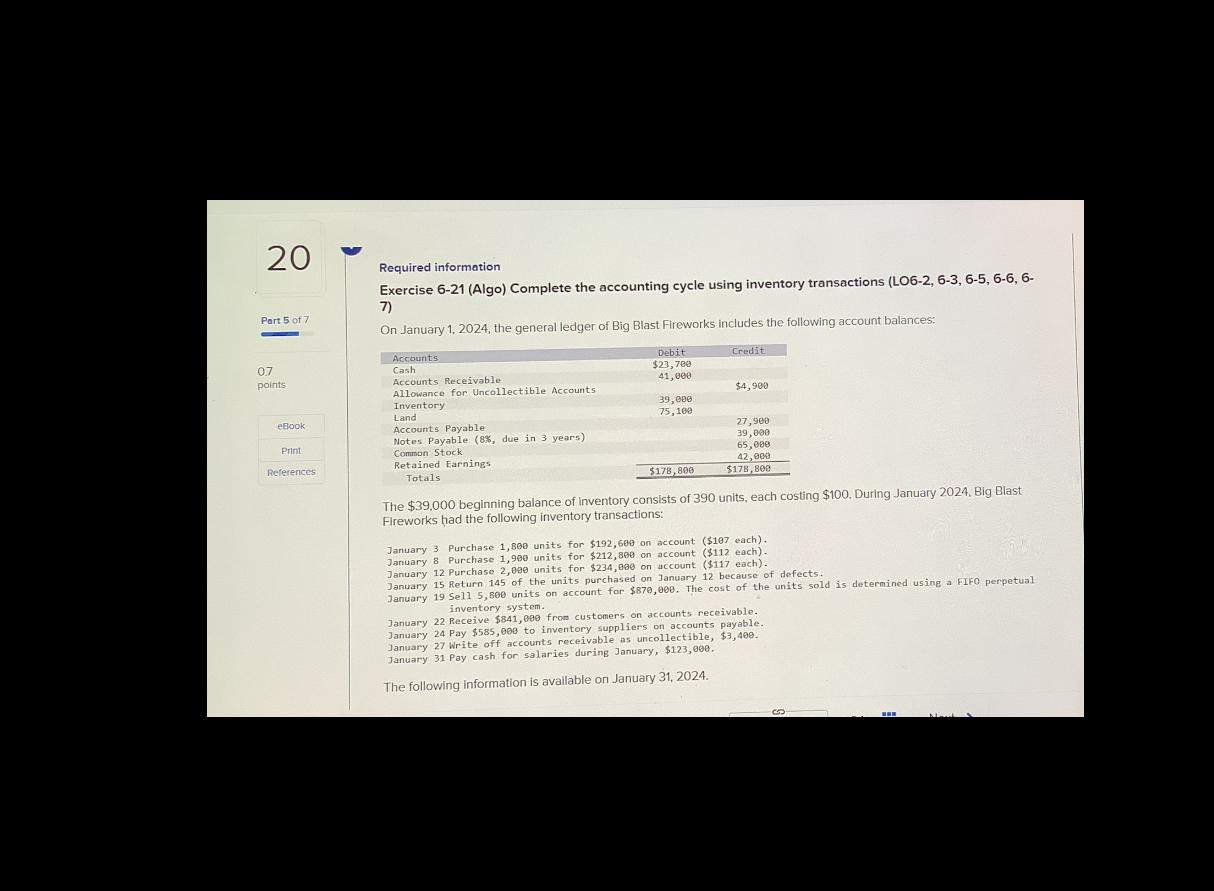

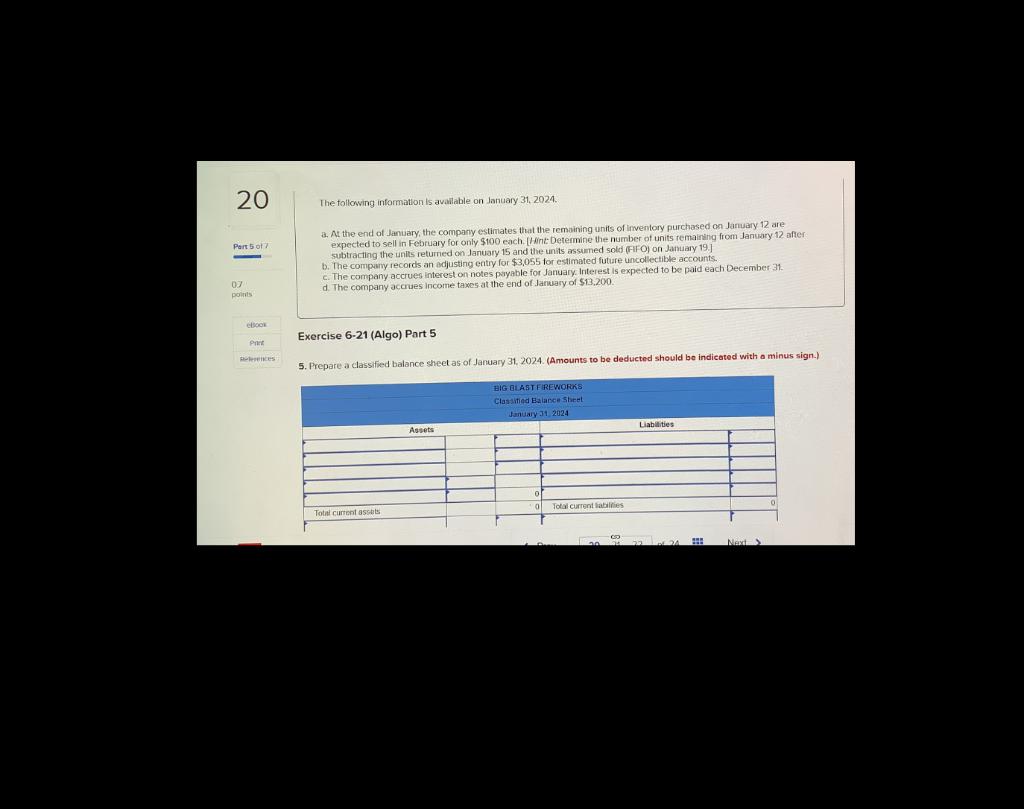

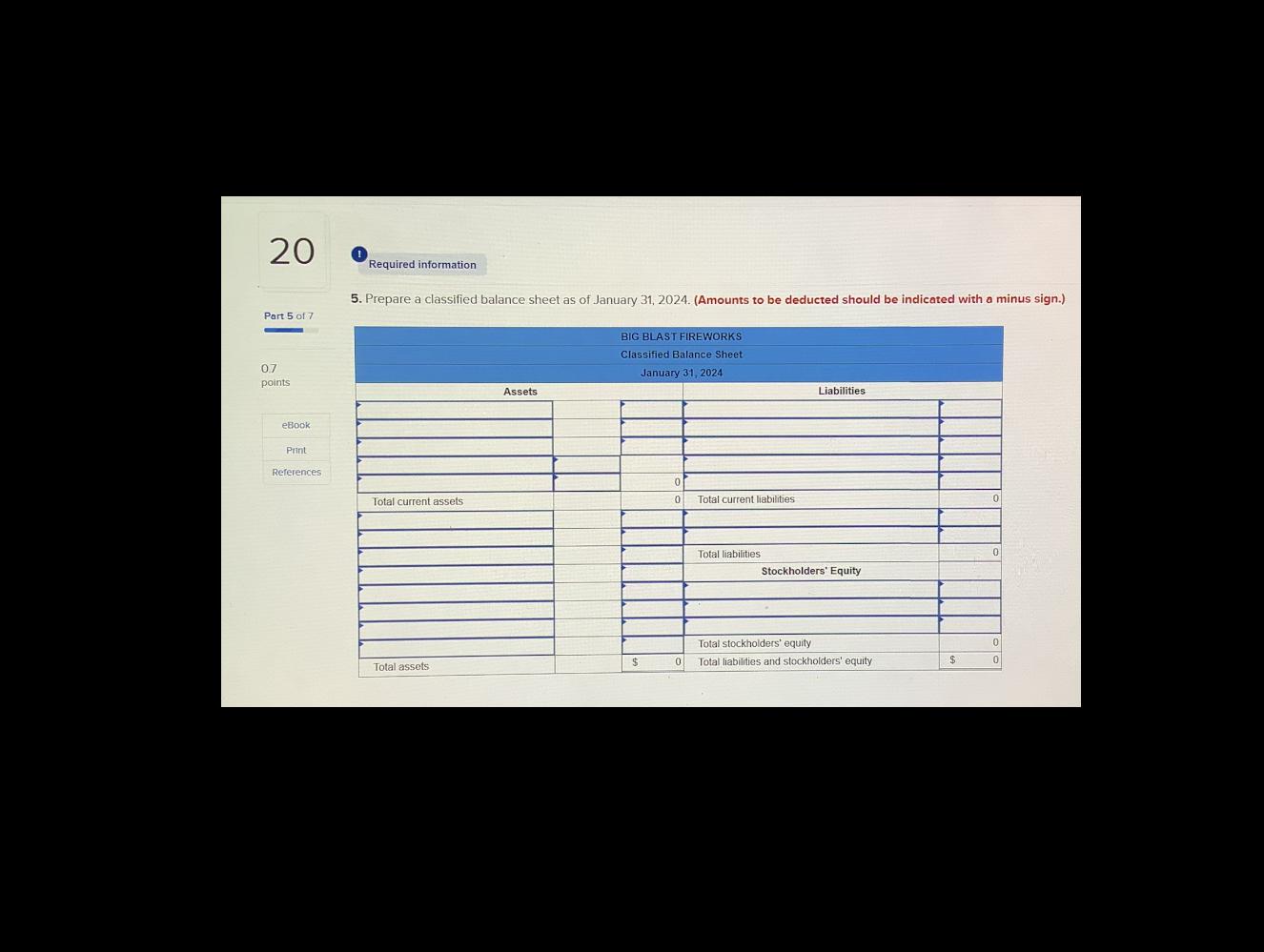

Required information Exercise 6-21 (Algo) Complete the accounting cycle using inventory transactions (LO62,63,65,66,6 7) On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: The $39.000 beginning balance of inventory consists of 390 units, each costing $100. During January 2024 , Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,800 units for $192,609 on account (\$107 each). January 8 Purchase 1,990 units for $212,800 on account (\$112 each). January 12 Purchase 2, 900 units for $234,800 on account ( $117 each). January 15 Return 145 of the units purchased on January 12 because of defects. January 19 Sell 5,800 units on account for $870,000. The cost of the units sold is determined using a FIFO perpetual inventory system. January 22 Receive $341,080 fron customers on accounts receivable. January 24 Pay $585,000 to inventory suppliers on accounts payable. January 27 Write off accounts receivable as uncollectible, $3,406. January 31 Pay cash for salaries during January, $123,000. The following information is avallable on January 31,2024. The following information is available on January 31, 2024. a. At the end of January, the compariy estimiates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint Determine the number of units remainang from lanuary 12 after subtracting the units returned on January 15 and the units assumed sold (FFO) on January 19.] b. The compary records an adjusting entry for $3,055 for estimated future uncollectible accounts. c. The company accrues interest on notes payable for January. Interest is expected to be paid each December 31. d. The company accrues income taxes at the end of January of $13,200. Exercise 6-21 (Algo) Part 5 5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign-) 5. Prepare a classified balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts