Question: Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 82,83 [The following information applies to the questions displayed below.] At the

![depreciation LO 82,83 [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e67b2769e9a_83866e67b26eb6b5.jpg)

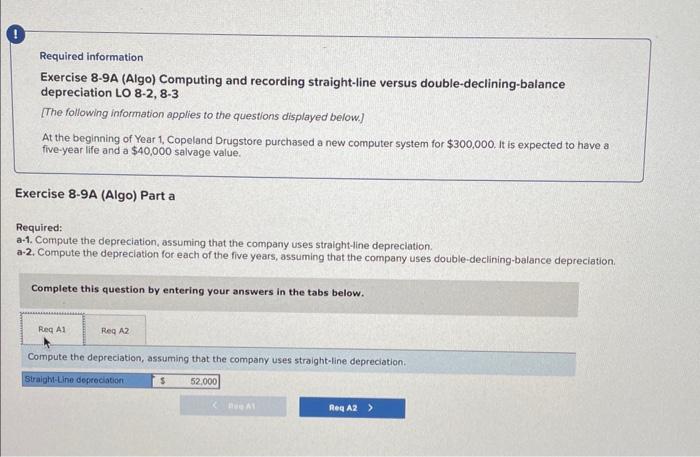

Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 82,83 [The following information applies to the questions displayed below.] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $300,000. It is expected to have a five-year life and a $40,000 salvage value. Exercise 8-9A (Algo) Part a Required: a-1. Compute the depreciation, assuming that the company uses straight-line depreciation. a-2. Compute the depreclation for each of the five years, assuming that the company uses double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Compute the depreciation, assuming that the company uses straight-line depreciation. Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 82,83 [The following information applies to the questions displayed below.] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $300,000. It is expected to have a five-year life and a $40,000 salvage value. Exercise 8-9A (Algo) Part a Required: -1. Compute the depreciation, assuming that the company uses straight-line depreciation. a-2. Compute the depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation Complete this question by entering your answers in the tabs below. Compute the depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation. depreciation. Note: Leave no celis blank - be certain to enter " 0 " wherever required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts