Question: Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 8-2, 8-3 [The following information applies to the questions displayed below.] At

![below.] At the beginning of Year 1, Copeland Drugstore purchased a new](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66df10ea1e7d4_88966df10e9b63f9.jpg)

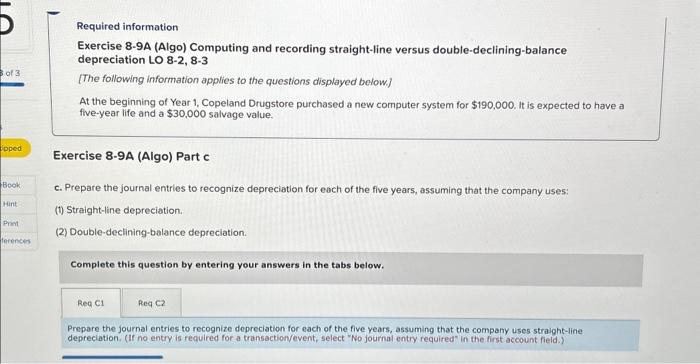

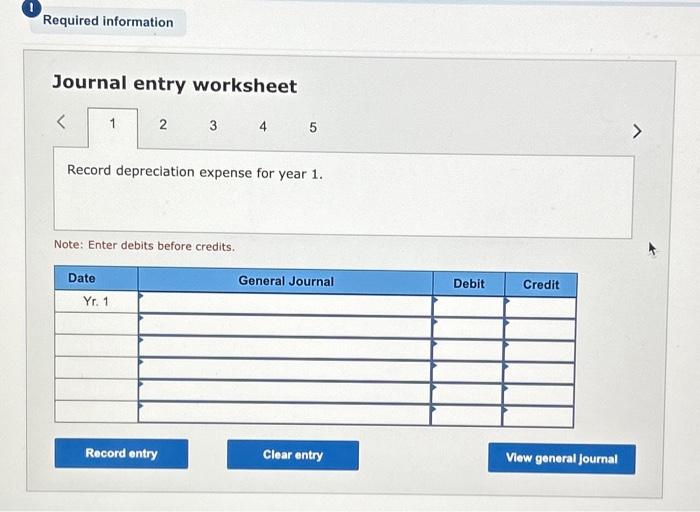

Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 82,83 [The following information applies to the questions displayed below] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $190,000. It is expected to have a five-year life and a $30,000 salvage value. Exercise 8-9A (Algo) Part c c. Prepare the journal entries to recognize depreciation for cach of the five years, assuming that the company uses: (1) Straight-line depreciation. (2) Double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required information Exercise 8-9A (Algo) Computing and recording straight-line versus double-declining-balance depreciation LO 8-2, 8-3 [The following information applies to the questions displayed below] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $190,000, it is expected to have five-year life and a $30,000 salvage value. Exercise 8-9A (Algo) Part c c. Prepare the journal entries to recognize depreciation for eoch of the five years, assuming that the company uses: (1) Straight-line depreciation. (2) Double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. (Ir no entry is reguired for a transactionvevent, select "No journal entry required" in the first account fieid.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 5 Record depreciation expense for year 1 . Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts