Question: Required information Exercise 9 - 2 4 ( Algo ) Complete the accounting cycle using long - term liability transactions ( LO 9 - 2

Required information

Exercise Algo Complete the accounting cycle using longterm liability transactions LO

The following information applies to the questions displayed below.

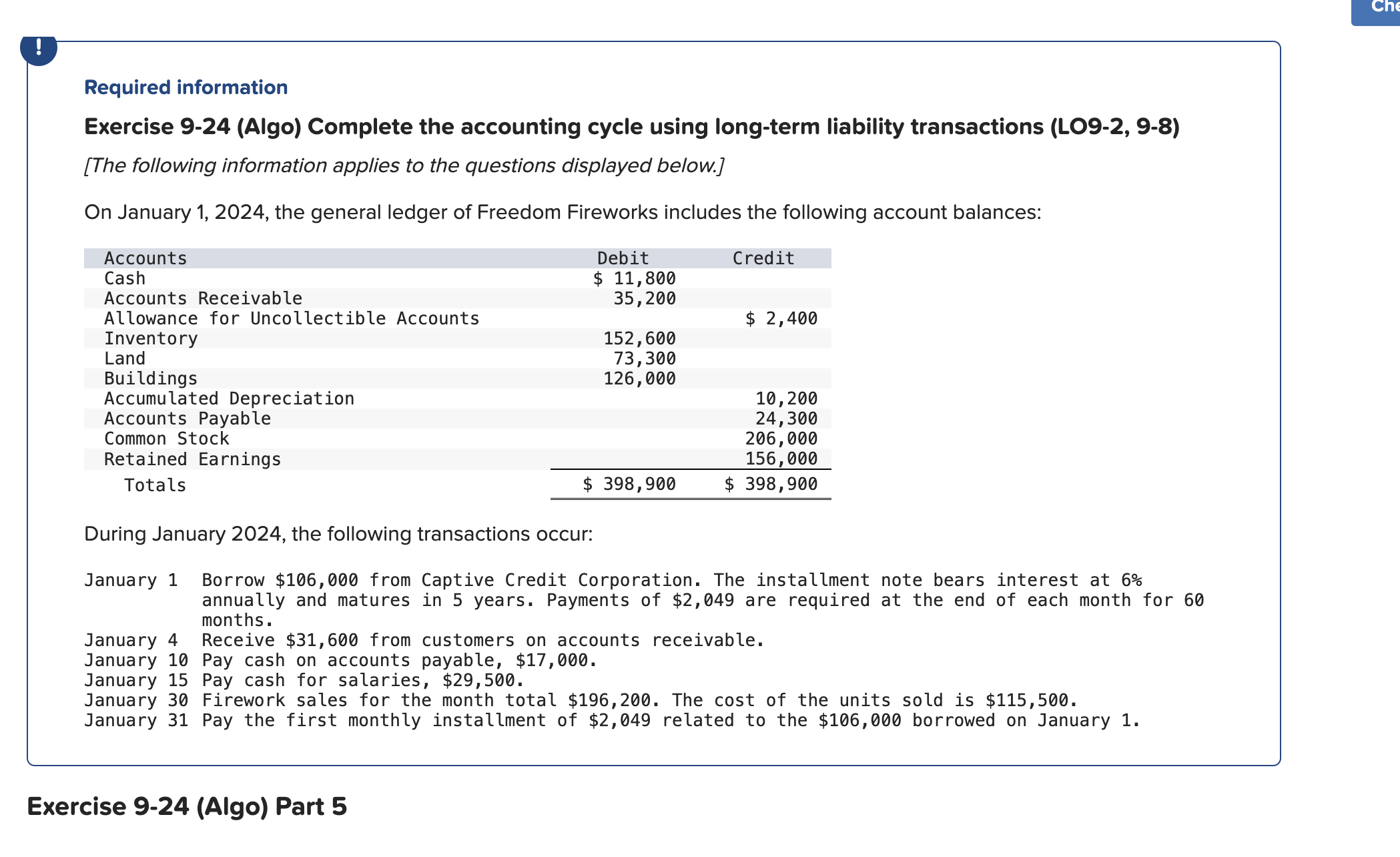

On January the general ledger of Freedom Fireworks includes the following account balances:

During January the following transactions occur:

January Borrow $ from Captive Credit Corporation. The installment note bears interest at annually and matures in years. Payments of $ are required at the end of each month for months.

January Receive $ from customers on accounts receivable.

January Pay cash on accounts payable, $

January Pay cash for salaries, $

January Firework sales for the month total $ The cost of the units sold is $

January Pay the first monthly installment of $ related to the $ borrowed on January Prepare a classified balance sheet as of January Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations.

Answer is not complete. Exercise Algo Part

Record closing entries. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field. Do not round intermediate calculations.

Journal entry worksheet

Record the entry to close the revenue accounts.

Note: Enter debits before credits. Record closing entries. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field. Do not round intermediate calculations.

Journal entry worksheet

Record the entry to close the expense accounts.

Note: Enter debits before credits. Exercise Algo Part

Analyze the following for Freedom Fireworks:

Requirement :

a Calculate the debt to equity ratio.

a If the average debt to equity ratio for the industry is is Freedom Fireworks more or less leveraged than other companies in the same industry?

Requirement :

b Calculate the times interest earned ratio.

b If the average times interest earned ratio for the industry is times, is the company more or less able to meet interest payments than other companies in the same industry?

Requirement :

c Based on the ratios calculated in a and b would Freedom Fireworks be more likely to receive a higher or lower interest rate than the average borrowing rate in the industry?

Complete this question by entering your answers in the tabs below.

Calculate the debt to equity ratio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock